According to Mergermarket, in 2018 saw a record number (1,107) of technology deals, the largest being IBM's purchase of Red Hat at $32.6 billion.* Experts predict that this trend will continue into 2019. Yet even M&A teams that aren't acquiring tech firms must play close attention to technology used by the target firm, as often the greatest M&A deal value risk involves technology in some form or fashion. These three lessons will help keep your team from making expensive technology-related mistakes during your next deal.

Learn from the Big Five

Known as the Big Five, Alphabet, Amazon, Apple, Facebook and Microsoft are all highly acquisitive organizations. Yet for the most part they have steered away from acquisitions that would complicate their core business models with complex post-merger integrations.

Instead, the Big Five seem to favor strategic acquisitions of small to mid-sized companies that add to their technological capabilities, positioning them to disrupt companies across industries. Rather than getting wrapped up in whatever is "shiny and new," they maintain a tight focus on acquisitions that complement or enhance their existing capabilities and capacities. In other words, they don't acquire technology for technology's sake.

As your M&A team evaluates potential technology targets, think about each target's technology and its true value proposition. It is often helpful to conduct a simple SWOT analysis:

- Strength: The technology is attractive and will add to deal value.

- Weakness: The technology will likely make integration longer and more costly, risking deal value.

- Opportunity: The technology will contribute to synergies and/or is truly better than that of the acquirer.

- Threat: The technology introduces significant dis-synergies that could undermine deal value.

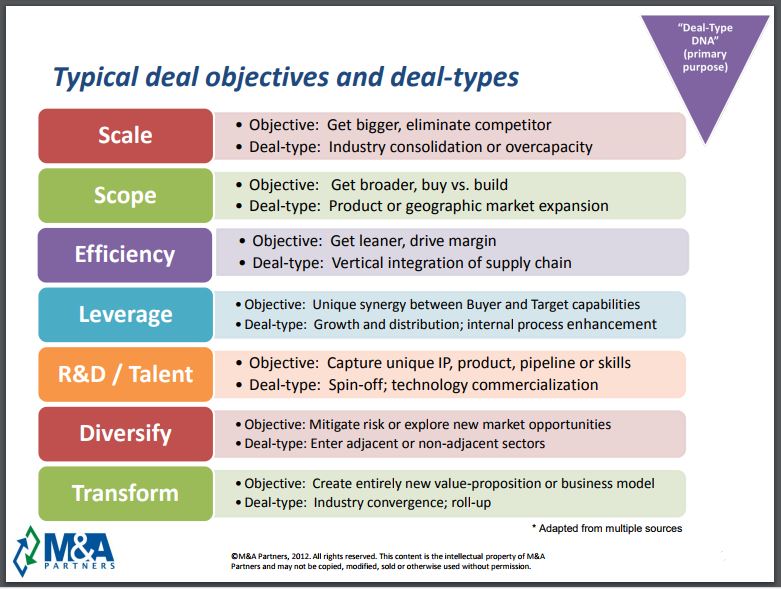

You should also think in terms of your "deal-type DNA," that is, the fundamental code of what actually drives value in a deal. Before moving forward on any acquisition (technology or otherwise), it is critical to define your deal-type DNA because it shapes everything from the questions you ask during due diligence, to your integration choices. Failure to understand deal-type DNA consistently leads to integration mistakes, which can be especially expensive when they relate to technology.

Remember the Four Pillars of Data Management

While the acquisitions of previous generations were often for physical assets, or more recently, for human capital, today's acquisitions are often about data. And that presents a new challenge for many acquirers with less expertise in data management. Before your organization moves forward with any acquisition, consider these four pillars of data management:

- Integration: Meta data and master data are involved in both certified and uncertified data integration. Meanwhile, exploiting traditional databases alongside unstructured data (often residing in data lakes today) is increasingly common.

- Manipulation: Heuristic manipulation of massive data volume is a core requirements challenge, and technologies must keep up with this volume.

- Quality: Rigorous attention to the quality of incoming data is essential, but the sheer quantity of data makes it difficult to detect and handle duplicate, bad or missing data.

- Governance: Traditional governance methods like version control, coding and testing standards must be applied to data management. Non-traditional governance, such as individual-level data management, may also need to be applied. The tendency is to operate without these structures and disciplines.

As you conduct IT due diligence, evaluate how each target addresses these four pillars. For example, the discovery of poor data quality could negatively impact your valuation of a target. On the other hand, a target's strong governance model might be something that your organization adopts thanks to its potential to protect against costly data breaches.

Think Beyond the Technology Life Cycle

Not so long ago, the internet was considered cutting-edge technology. Yet now must businesses could hardly function offline. Just as every M&A deal has its own life cycle, so does technology. Every technological innovation falls into a stage of this life cycle:

- Mature technologies have been widely adopted and may be ubiquitous. They include, for instance, best-of-breed enterprise applications; on-premise data centers; virtualization; and identity and access management.

- Maturing technologies have not been universally adopted and are often adopted very unevenly. Data as a service (DaaS) falls into this category, as do some mobile and social technologies.

- Emerging technologies are relatively new, and their enterprise implications are still not totally understood or realized. Examples of emerging technologies would be the Internet of Things (IoT), machine learning, artificial intelligence and blockchain.

It's easy to assume that if both companies use the same technology, integration will be straightforward. Yet two organizations can be using mature (or even dying) technologies in very different ways. These differences are often amplified with maturing or recently emerged technologies, and even greater still with emerging technologies. Thus a simple match of life cycle isn't enough to ensure success.

The use of mobile technology, considered maturing, is an excellent example, Integration may be complicated by widely disparate mobile-enabled business processes or systems integration architectures. Furthermore, the use of mobile technology contributes to company culture; while moving to mobile was a bigger change, taking it away is an even bigger one.

*Source: Mergermarket 2018 Full-year Global M&A Trend Report

John is a featured presenter at M&A Leadership Council's The Art of M&A Integration in San Diego this July. The presenters are eager to share their real-world experience and equip you to more effectively plan and execute a successful post-merger integration.