Historically it was not uncommon for HR to get a “seat at the table” late in the M&A process, if they were offered a seat at all. We are happy to report that we have heard from many of our HR colleagues that HR is engaged earlier and at a more strategic level. If HR is engaged late in the M&A process it can result in unrealized synergies and additional deal value erosion for domestic M&A deals.

But in the case of cross-border M&A, failing to include HR can have much more serious implications. The HR team is uniquely qualified to navigate issues of logistics; organizational and national culture; and regulatory and legal issues that so often prevent the attainment of maximum deal value.

Multiple Country Dynamics

If you’ve worked on domestic M&A deals before, then you already know they have plenty of moving parts. In cross-border deals, HR professionals must consider multiple additional logistics issues.

- Language: There is always a risk for misunderstanding when people are using a second language, no matter how proficient in that language they may be. In addition to potential for misinterpretation, there’s also opportunity for mismatch in formality, directness and display of emotion. And even if individuals at the target company speak English, they may be not be comfortable conducting business in a non-native language. This can be incredibly stressful, especially during major business transactions or complicated negotiations.

- Time-zone differences: Employees from the buyer and target companies may exhibit varying degrees of willingness to be flexible in accommodating the needs of people in other time zones. As HR leader, you’re well positioned to discuss the importance of flexibility and accommodation whenever possible

- Employee benefits: In many cross-border M&A deals, the HR team must build in even more time for employee benefits transfers. This process is already a frequent source of delays in domestic deals, and cross-border deals are even more complicated. The HR team should work closely with the legal team and engage HR in each country to maintain continuity of employee benefits.

Organizational and National Culture

Organizational cultural incompatibilities are a leading cause of deal failure for domestic M&A deals. In cross-border deals, the HR team must also contend with differing national cultures, which can impact everything from work hours to leadership expectations.

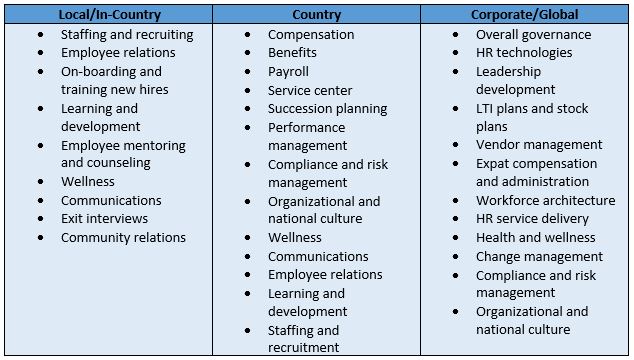

- Varying roles for HR: The roles and responsibilities of HR may change based on local culture. In some places, the HR team acts as “order takers,” while they act as strategic advisors in others. Be mindful that your cross-border counterparts may not have the same level of input as you. Furthermore, as an HR leader you may even encounter resistance to your participation or leadership during due diligence and integration.

- Differences in work practices: HR leaders usually find that in addition to differing response times and attitudes toward vacation and work hours, foreign labor markets are also more heavily regulated. These regulations require careful analysis during due diligence.

- Human capital differences: Differences in employment practices, plans and program design, for instance, can even influence how you ask questions during the due diligence process. Furthermore, the structure of the deal itself may change from country to country, further complicating the human capital puzzle.

- Feeling loss of control: Staff outside of headquarters may feel out of control, potentially affecting quality and timeliness of work; the level of cooperativeness; and willingness to work toward resolution of people issues that affect deal value and productivity.

- Risk of poor coordination: Despite a strong need for multi-national coordination, HR leaders may encounter reluctance to adopt central control from one foreign country. Consider which issues can actually be handled at the local or national level, versus those that must truly be controlled from the U.S.

Regulatory and Legal Issues

To navigate the additional regulatory and legal issues of cross-border M&A deals, the HR team must work closely with an interdisciplinary team that includes both legal and accounting.

- Information: Outside the U.S., publicly available information is much more limited, and accounting disclosures tend to be much less reliable. From an HR perspective, this means that HR leaders not only will have much less information available during due diligence, but also will need to be much more protective of confidential employee information.

- Labor relations: Each country has its own labor relations challenges. In some countries, it’s necessary to consult unions, works councils or employee representatives prior to finalizing any merger or acquisition. These entities may have considerable power, including the power to prevent a deal altogether. HR leaders should ensure that adequate time and resources are dedicated to navigating these labor relations concerns.

- Immigration considerations: Employees at the target company may be employed through work permits or visas, and all these documents will need to be properly transferred. In some transactions new permits or visas may be required prior to the employee being employed by the buyer, especially in an asset transaction. Meanwhile any of the buyer’s employees who will be working on site at the foreign subsidiary will also need to complete all required documentation. HR should identify these immigration issues during the due diligence phase and oversee their completion.

- Employment regulations: Outside the U.S, at-will employment is incredibly uncommon. Most countries require significant notice and severance—along with cause—for terminating employment, and often a simple duplication of roles due to an acquisition is insufficient cause. Furthermore the HR team must be aware of any limitations on changing the terms and conditions of employment.

- Tax implications of informal integration activities: It’s not uncommon for foreign subsidiaries to confer significant tax benefits for deals that are structured as mergers. However, these advantages can be negated if HR and business teams undertake any informal integration activities (sometimes called “deemed integration”), such as consolidating reporting lines or locations.

To learn more about HR challenges in cross-border M&A, please join us in May for The Art of M&A for HR Leaders. Hosted by the M&A Leadership Council, this program is for senior leaders and HR professionals who will lay the foundation for leading critical actions in each deal phase to capture deal value through people. Learn more.