Part 2: Six Essential Components for your IMO Playbook & The Single Most Overlooked Requirement

By Mark Herndon, Chairman and CEO of the M&A Leadership Council

In Part 1, “IMO Playbook: Your Coach’s Handbook to M&A,” we discussed the importance of having an integration management office (IMO) playbook and the business results other companies have experienced by using an effective IMO playbook. Part 2 in this series will help you identify how your current playbook stacks up and how you can improve it. If your company has acquired in the past, you’ll have components at a basic level for a solid playbook. In our experience with different types, sizes, and experience levels of acquirers over the years, we have found that most IMO playbooks fall short, both in what they should contain and more importantly, what they can accomplish.

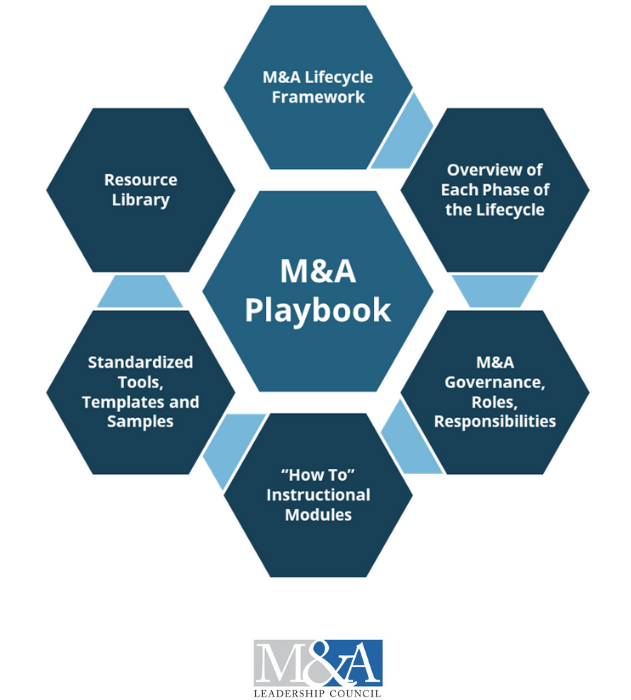

We believe a best-in-class IMO playbook should contain at least these six essential components. Each is described in further detail below.

We believe a best-in-class IMO playbook should contain at least these six essential components. Each is described in further detail below.

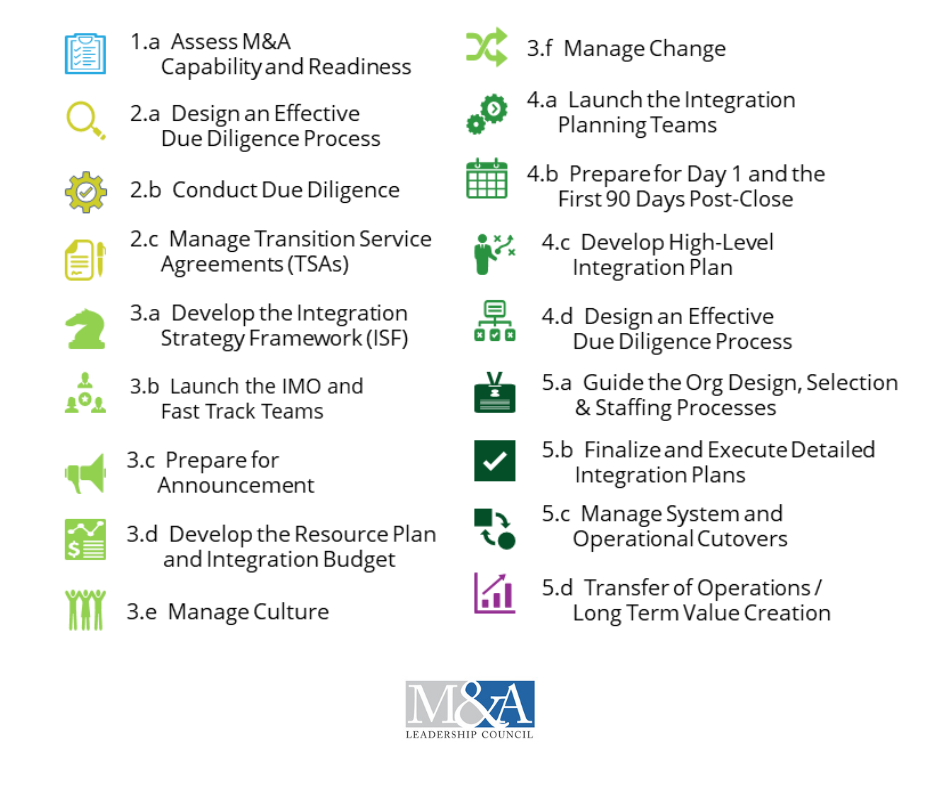

- An M&A Lifecycle Framework.

- An Overview of Each Phase of this Lifecycle

- M&A Governance, Roles & Responsibilities

- Standardized Tools, Templates and Samples

- A Resource Library or Knowledge Base

- “How-To” Instructional Modules

1.M&A Lifecycle Framework

An M&A lifecycle framework is your company’s high-level operating model summary of “how we do M&A here.” In our view, it should be a true enterprise-level “end-to-end” process map that starts with strategy and targeting, continues through due diligence and completion of the transaction, and encompasses all phases of integration, transition, and optimization. Given the breadth and complexity of a true end-to-end process overview, we believe it is important to keep it simple. It should be limited to a one-page representation so all stakeholders can quickly grasp how it all works together. In a live deal situation, your team must be able to quickly determine “where are we?” and then align on the next steps and requirements.

Don’t miss the importance of the lifecycle framework just because it’s a high-level overview. It’s the backbone of internal M&A capability. Without it, you’ll find it nearly impossible to organize and coordinate, much less speak the same language, or get everyone on the same page.

Make sure your lifecycle framework accomplishes each of these needs:

- Define All End-to-End Phases, Completion Gates, and Sequencing. M&A is not a purely linear “boxcar” process. A great deal of M&A activity is parallel, overlapping, and simultaneous, not merely sequential. Therefore, each phase must have a specific completion gate and an indication of which components are typically parallel and simultaneous vs. strictly dependent on full completion of prior steps.

- Identify Key Objectives, Actions, and Deliverables. One of the key distinctions of an effective lifecycle is designating “what happens and when” in each phase. This needs to include things like decisions, key milestone events, actions, outcomes, and deliverables for each phase in the lifecycle. This is still a high-level summary – the detailed “who to or how-to” information comes later.

When designed well, your M&A lifecycle framework provides the architecture for leading, managing and executing M&A successfully. Also, it is the essential organizing and planning structure that all subsequent tools, templates, knowledge content, and instructional modules should be slotted into for “just-in-time” use by team members.

How many playbooks should you have?

We suggest having a baseline playbook supported by your two or three most typical (or most anticipated) deal type variations. For example, if your company primarily acquires smaller tuck-ins that are privately owned companies, but your current strategic mandate calls for the acquisition of a much larger public company, get ready now. It’s going to be way different. Other “variations on a theme” will be driven by considerations such as whether you are doing a stock vs. asset deal; various global and country-specific requirements; a sell-side divestiture and/or a buy-side carve-out acquisition; and potentially, highly transformative deals representing a substantially new or different “DNA” of technology, geography, customer segments or operating models. Even with many different deal-types, a robust and effective lifecycle framework will help your team quickly determine differing major requirements and “common core" requirements standardized across most deal types.

2.Overview of Each Phase of the M&A Lifecycle

M&A moves faster now than ever before. You must deploy skilled and effective resources quickly and in the heat of battle or risk losing deals or destroying value.

At the same time, internal resources capable of executing M&A are harder to find and retain. As a result, most acquirers will use a smaller and experienced core M&A team - that may be either fully or partially dedicated to M&A- but supported by newer IMO or function-team resources with little to no prior experience. Especially in these situations, your playbook must deliver an efficient onboarding for these newer resources; or those moving into new and more comprehensive roles.

Companies that document and deliver a solid overview of what happens in each phase (but stop short of requiring proficiency with specific tools or deliverable requirements) build internal value and increase the pace of value-capture. While not entirely prescriptive, a good phase overview should succinctly answer questions like:

- What is the overarching purpose of this phase?

- What are the key tasks necessary to achieve the objectives of this phase?

- Who is responsible for the deliverables in this phase?

- What tools are needed to complete the tasks in this phase?

- What reporting methods and frequency are required in this phase?

- What instructional modules are available for this phase?

- What legal requirements apply to this phase?

- What culture, change, and communications are necessary in this phase?

- Or others as appropriate to your organization and deal type.

3. M&A Governance, Roles and Responsibilities

The M&A governance, roles and responsibilities section of your playbook is absolutely mission-critical. Nearly all acquirers struggle with setting up appropriate and efficient governance models that are purpose-built for their specific level of deal volume, type, and pace, yet there’s no other way to do it. This section of your playbook must identify the decision authorities and the work-stream structure and scope needed, even down to the RACI level (e.g., “Responsible, Accountable, Consulted, Informed”). Whether running a due diligence process or an integration, everything will be set up around these decision authorities, roles, and responsibilities, so you must clearly define and document who does what and when. There is often confusion around M&A because it may not follow your exact organizational structure. For example, highly sophisticated acquirers routinely use a mix of both functional work-streams and truly cross-functional, process-oriented, or value-capture work-streams. You must clarify how these structures work and how they interface with the broader team structure down to the finer points of who is involved in deciding which type and level.

the decision authorities and the work-stream structure and scope needed, even down to the RACI level (e.g., “Responsible, Accountable, Consulted, Informed”). Whether running a due diligence process or an integration, everything will be set up around these decision authorities, roles, and responsibilities, so you must clearly define and document who does what and when. There is often confusion around M&A because it may not follow your exact organizational structure. For example, highly sophisticated acquirers routinely use a mix of both functional work-streams and truly cross-functional, process-oriented, or value-capture work-streams. You must clarify how these structures work and how they interface with the broader team structure down to the finer points of who is involved in deciding which type and level.

One final governance caution – if your company is scaling its M&A operations from 1-2 deals per year on average to more of a serial acquisition approach (e.g., multiple, ongoing, concurrent, and overlapping deals across various business units, regions or P&Ls) – watch out! A serial acquirer’s optimal governance approach and structure need to be vastly different from a “one-at-a-time” approach.

4.Standardized Tools, Templates and Samples

Tools and templates are important – until you over-complicate your playbook by throwing in “everything but the kitchen sink.” Remember, less is best, so make them count by efficiently deploying just those core tools, templates and samples that will be used on every transaction or that you are standardizing on across your enterprise or work-stream team.

Team members need this guidance but will be quickly overwhelmed if your playbook resembles an “all you should ever know about M&A” compendium vs. a convenient “grab-and-go, real-time job aid.”

Your specific toolset and sample templates should be customized to your company and M&A lifecycle process. Here are a few integration-related tools/templates we believe will help you the most, each provided merely as an example to consider and as a thought starter.

- Integration Strategy Framework. How does your company effectively translate the strategic business case for a deal; then, incorporate key due diligence findings and provide the critical “must accomplish” integration objectives, givens and guiding parameters needed to launch integration planning?

- Team Charter Template. Don’t be fooled by simple, standardized work-stream charters. Unless each team clearly understands what is in scope versus what is “off-limits” or a critical dependency with another team, you’ll be struggling from the outset.

- Discovery “As Is/To Be” Data Capture Template. We are sticklers on this point. A significant root cause of integration value-erosion or all out value destruction is a lack of sufficient understanding of the Target Company’s operating model and processes, etc. Why it does what it does, and how it does it. This is a critical part of helping BOTH counterparts more fully appreciate the complexities and logic of what must then be optimized.

- Decision Calendar. Another root cause of integration failure can be directly attributed to slow, inefficient decision processes. Your IMO supports and enables the Steering Committee to make effective, timely decisions by helping to frame the timing, process and data/decision alternatives required from key SMEs and work-streams.

- Integration Plan of Record (IPOR) Template, Sample and Summary Report. This is the “guts” of what many companies historically called a playbook. These are the detailed integration plans defined by work-stream, objective or milestone, task/sub-task, timeline/complete date, accountable persons, budget, etc. You’ve got to have this, but of equal, and perhaps even greater importance, is the summary report showing the top priority milestones by work-stream and quarter. Without the visual “steering wheel” for your Steering Committee, you’ll run into a lot of unanticipated priority and resource conflicts.

- Value Driver Dashboard. As one highly experienced and effective corporate development leader told me recently, “Hey, unless EVERYBODY on the integration is focused on value-capture, what’s the point?” I love that thinking. But value-capture often gets lost in the integration shuffle of KPIs, percentage completes, and RYG statusing. It is far better to establish a one-page “mini-balanced scorecard” type of report. It should reflect specific value-capture initiatives across the most relevant business outcome categories for each specific deal and use criteria to track and report progress on those initiatives as a leading indicator for the overall outcomes anticipated by each deal.

5.Resource Library

We believe you’ll get solid value by providing a resource library. Given the complex issues and intense time pressure in every deal, assembling and maintaining essential external publications and other internal knowledge content is widely applicable. Again, less is best, but from experience, we’ve found it helpful to make these types of content readily available:

- Definition of Terms, including all the acronyms – we have our M&A language

- Approval Guidelines and Timelines (i.e., Board Approvals, HSR, Regulatory Guidelines for your industry

- Enterprise Business Process and System Maps – it’s helpful to see, on paper, how things work and how they are connected, which can help with dependency mapping.

- Integration Resourcing Guidelines – who do we tap for sub-teams?

- Integration Budgeting Guidelines

- Link to Integration Travel and Expense Policies

- Best Practice Articles and Whitepapers – for each work-stream, process team or value-capture team

- Hart–Scott–Rodino Antitrust Improvements Act, and what that requires

- The legal do’s and don’ts of what you can share pre-close

- And others, selectively, that will add “how-to” or “what to” insights during live deals vs. purely “general knowledge.”

6.“How To” Instructional Modules – The Most Common Omission

So, what’s the most common missing playbook component? Hands down, it is this one. Think about it this way: M&A is an experience-driven skill set. You can’t learn it by reading a book. Instead, you must go through the drill repeatedly, each time observing the facts/specific situation and adapting and applying the core principles to accomplish the desired results most effectively. The secret sauce is your organization’s ability to learn quickly and apply that insight to live-deal and real-time issues.

So, what’s the most common missing playbook component? Hands down, it is this one. Think about it this way: M&A is an experience-driven skill set. You can’t learn it by reading a book. Instead, you must go through the drill repeatedly, each time observing the facts/specific situation and adapting and applying the core principles to accomplish the desired results most effectively. The secret sauce is your organization’s ability to learn quickly and apply that insight to live-deal and real-time issues.

To us, that means much more than just listing principles and concepts. It means highly effective and experientially-focused training that’s all about applied learning. That’s what we work hard to accomplish in every M&A Leadership Council training event, whether public, private or an in-house event. Designed and deployed effectively, the right “how-to” instructional modules can be real game changers in accomplishing the consistent, repeatable results your M&A team is expected to deliver.

So, what instructional modules should you include in your playbook? These are examples of some of the most popular “how-to instructional modules for key deliverables” clients have asked us to develop. Your needs will vary based on overall internal experience level, deal volume, deal type, pace, and the results your business case requires.

How you deliver this “how-to” content is almost as important as the content itself! Gone are the days when you could pull all functional leads into the same room for a couple of days. We recommend a “real-time job aid” focused approach.

- Deliver concise, application-oriented modules (and micro-modules) at each phase, task, or requirement via your in-house on-demand learning management system.

- Support that by appropriate virtual, instructor-led courses and more intensive problem-solving work-outs and networking events to maximize peer-to-peer learning.

Finally, leverage a best-of-both blend between your company-specific “how-to’s” and our best-in-class executive training courses licensed to or delivered for your team, and your M&A business outcomes will show the improved results!

What About M&A Software?

Purpose-built M&A software can help streamline and simplify repetitive tasks and keep integration executives informed. When paired with a comprehensive and effective IMO M&A Playbook, the software can help improve your team's ability to deliver consistently repeatable results. However, M&A software is only valuable to the degree it makes you more effective and efficient at M&A. Keep in mind that there is no one “best” software package. Instead, you need a solution that does what you need it to do in the way you want to operate M&A – and most importantly, one that your team will use.

For more information please refer to: The Smart Approach to Selecting a Fit-for-Purpose M&A Software Solution