Assessing Integration Risks Leads to Understanding Target Value Drivers

By Jack Prouty, Past President of M&A Leadership Council

While the due diligence process certainly can reveal the financial worthiness of the target, it often does not include an examination of the buyer or target’s business operational, organizational or cultural characteristics, or their readiness to become integrated.

The focus of leadership’s attention after a target has been identified is typically consumed with “doing the deal.”

The investment bankers are concerned with valuation and pricing, and the due diligence professionals are wrapped around the financials.

Whether the plan is to preserve, consolidate or integrate the two businesses, the non-financial characteristics of the deal have proven to be crucial to the planning and execution of a successful integration.

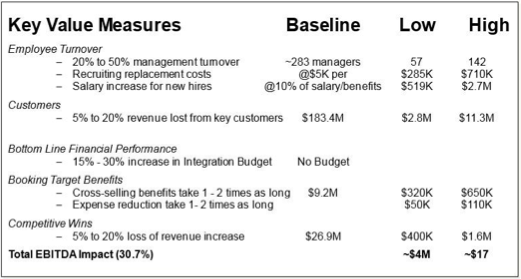

SAMPLE VALUE-at-RISK REPORT

$4 to $17 Mil in Value are Potentially at Risk

One of the essential keys to a successful outcome for an M&A is to conduct an assessment of the integration risks and organizational readiness for change as early as possible in the process.... i.e., during the period you are doing your normal due diligence.

The fundamental purpose for assessing the risk of integration for a potential acquisition is to identify possible issues, barriers and opportunities that may not have surfaced as a result of the formal due diligence.

These are the same issues and barriers that, left unresolved, could challenge the strategic, operational and financial objectives and goals of the deal.

Every potential acquirer must ask itself how ready it is to bring the target into the fold. Are the objectives for doing the deal obtainable? Is this target operationally sound and are their best qualities transferable?

There is a scientific methodology and approach to these questions that will identify the risks and readiness for both companies to make the strategic vision a reality.

An Integration Risk Assessment can assess, at a high level, their preparedness to successfully integrate the organizations and thereby achieve the strategic, operational and financial goals of the deal.

It can also help identify the areas of potential business risk that could present a challenge to meeting the deal’s stated objectives and goals.

An Integration Risk Assessment could assist the companies in determining the potential areas of value erosion, value realization (recovering the price premium and integration costs as well as achieving the expected synergies), and leveraging the value creation opportunities. It can also provide a value-at-risk proposition that quantifies the potential risk of critical asset erosion, and an integration framework and logic that qualifies the potential risk of critical asset erosion. It would also help to identify the path forward for successfully integrating the businesses.

Activities surrounding a typical Integration Risk Assessment would include:

- Validating the acquisition strategy and rationale

- Assessing the strategic fit with your business and your operating model

- Identifying the value drivers and determining the ability to capture or leverage

- Determining areas of business risk and integration complexities (organizationally, strategically, operationally and culturally)

- Outlining a Critical Success Factor Readiness Report Card

- Developing as an output the Value-at-Risk for this acquisition / integration

The first thing a company should do is clearly understand the value drivers of the acquisition candidate. While lots of people carelessly toss around the term “value drivers”, what is really meant by this term?

Value drivers distinguish a company from its competitors. They are the key elements that either build the value of a business or protect the value created.

Value drivers of a company will vary by industry, but here are the typical value drivers to be identified, understood and assessed for a potential acquisition candidate.

Each has some key questions to be addressed:

- Organization Value: How well is it aligned with our organization structure (functions, job titles, staffing levels, etc.)? Does it have established business processes and procedures: mature, evolving or very embryonic? Do they have a strong or weak infrastructure to support the business (support functions properly staffed and operated; skilled back office/core support functions, etc.)? How well is the business managed, at both the senior and functional level?

- Customer Value: What is their customer base vis-à-vis ours? To what degree do we serve the same customer base? Is their customer base concentrated or diversified? What is their customer value proposition? What are the characteristics and attributes of their customers? What is their share of market? What is the market pull for their products/services?

- Employee Value: Do they have strong, capable management? Does it have knowledge workers with strong functional/technical skills? Does it have a positive, enabling, employee-focused culture? Does its business values and treatment of its employees align with ours? Do their employees’ capabilities and skills set add value to us?

- Strategic Value: Does its business value chain align well with ours? Does it have strong brand recognition in its marketplace and with its customers? Does it have barriers to entry? Does it have a solid, realistic business plan and strategic vision for growth? Is it in a growth industry or market niche? Does it have a strong competitive position?

- Product and Service Value: Does it have high quality products or ser- vices? Does it complement, align with or expand our product and service offering? Does it have a good reputation in the market for product/service performance and reliability? Does it have a diversity of products and services? What is its R&D/Product Devel- opment pipeline?

- Goodwill Value: Does it have strong brands and product names? What is its reputation with key stakeholders: customers, employees, suppliers, community and investors? Do they own proprietary patents and are they unique and protected? Do they have valuable intangible assets such as logos, copyrights, licenses, or trademarks? What is their “special sauce”.... those things that make them special or unique?

It may not be possible to assess all of the questions brought up here, but these are the value drivers that need to be considered in evaluating an acquisition candidate.

With an understanding of the value drivers, and within the context of the Integration Risk Assessment activities outlined above, the end objective is to quantify the potential business value at risk (i.e. Value @Risk). This value-at-risk needs to be addressed and managed during the integration planning and implementation that follows the due diligence.

Here are the typical areas of value erosion that must be assessed and quantified as a buyer seeks to integrate an acquisition candidate into a business:

- What percent of the combined customer base will we lose upon integration (and why)? (Note: A best practice in some acquisitions may be that we retain 85-90% of our customers)?

-

Are there some products or services that we will cannibalize as a result of this merger (and what are the implications of that)? Do we have product/service overlap?

-

What are the risks and business impacts of changing brands, logos, company name of the acquired company? (Note: There are some significant examples of this, including Macy’s acquisition of Marshall Fields and then renaming their stores Macy’s)

-

Loss of key resources, management expertise, and technical know-how within the acquired company? (Note: For example, how often does the successful founder of a game-changing technology want to be part of a large, bureaucratic organization?)

-

Given the differences between our customer value propositions, how we face the customer, and how we reward and manage our sales forces, how successful are we going to be in effectively integrating this function in the new organization?

..... and the list goes on!

Bottom Line... to change the paradigm and be more successful at M&A integration, we need to start earlier in the process of understanding the areas of value and risks in the integration and thereby be in a position to better plan and manage the integration effort.

The Integration Risk Assessment resulting in a Value-at-Risk report-out, is an extremely valuable tool to add to every M&A toolkit.

---------------------------------------------------------

Learn more about mergers, acquisitions and divestitures at M&A Leadership Council's virtual or in-person training courses. Network with other M&A professionals while our expert consultant trainers will get you ready for your next transaction (or help an ongoing one) through practical insights, group discussions, case studies, and breakout exercises.