That Certain Something that Makes Them Unique

By Mark Herndon of the M&A Leadership Council and John Bender of M&A Partners

Preserving the target company’s “secret sauce” is probably one of the most often quoted, but least understood and applied principles for success in the entire M&A world. That statement is not just for shock value. Based on our observations over the last 30 years, we’ve seen countless cases of well-intentioned executives and acquiring organizations spoiling that “special something” in their recently acquired companies. Often at the same time they are publicly proclaiming their commitment to “build on the acquired company’s successes” or perhaps, “let the acquired company stand-alone.”

If you’ve attended one of the M&A Leadership Council training workshops over the years, you’ve no doubt heard any number of us use this phrase. It’s one of our favorites. And why not? It immediately helps executives think about essential deal thesis objectives that go the heart of why they wanted to buy that company in the first place. That’s the good news. The flip side is that we STILL see far too many acquirers blow it when it comes to walking the talk of preserving -- much less, leveraging -- the acquired company’s secret sauce.

So, What Is It, Exactly?

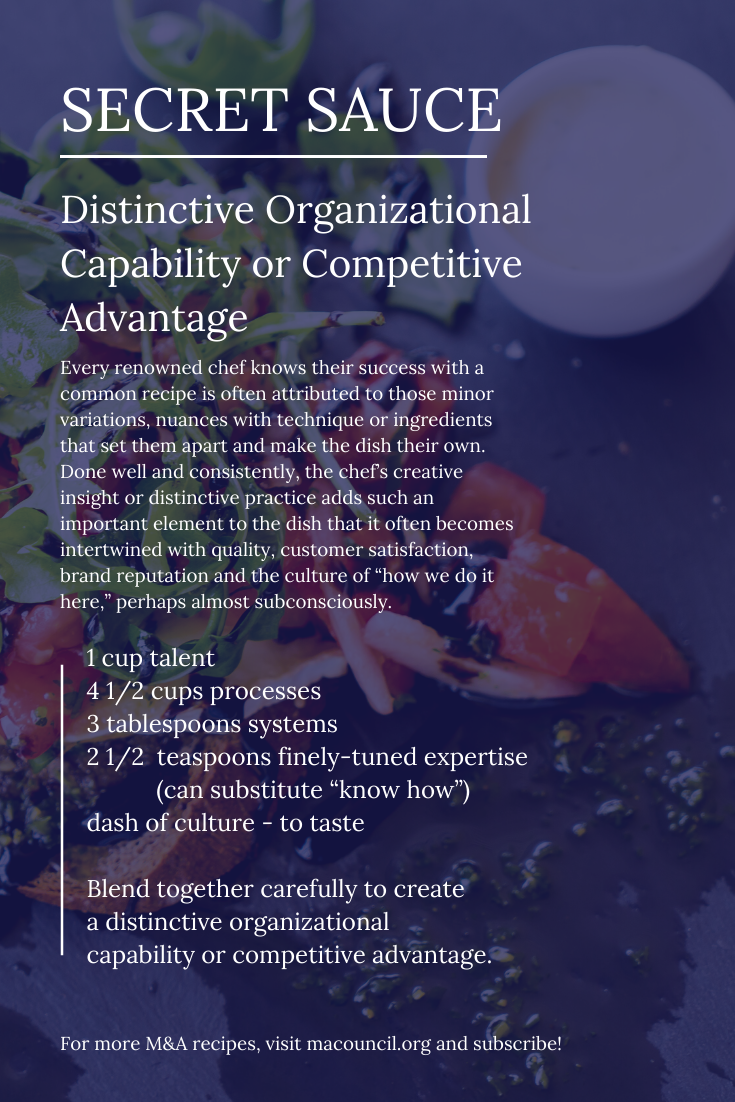

Every renowned chef knows their success with a common recipe is often attributed to those minor variations, nuances with technique or ingredients that set them apart and make the dish their own. Done well and consistently, the chef’s creative insight or distinctive practice adds such an important element to the dish that it often becomes intertwined with quality, customer satisfaction, brand reputation and the culture of “how we do it here,” perhaps almost subconsciously.

Most desirable target companies have perfected a similar recipe for success based on their unique and distinctive combined talents, technologies, processes, and collective “know-how.” Therein lies the first challenge of secret sauce. It’s typically not a single ingredient (e.g., a person, a product, a solution, a cultural attribute, a process, etc.) but a complex and highly intertwined organizational capability comprised of many components. Only when those unique and distinctive elements are combined and executed consistently over time, does the company perfect its secret sauce and become more valuable or more desirable than other comparable alternatives.

The French phrase, Je ne se quoi – translated literally, “I don’t know what” or “that certain something” – is quite apt for helping the acquiring executives to more effectively learn to identify and fully leverage secret sauce. In our view – secret sauce -- “that certain something” about a potential target company, can best be understood through the lens of operating model and business model.

The French phrase, Je ne se quoi – translated literally, “I don’t know what” or “that certain something” – is quite apt for helping the acquiring executives to more effectively learn to identify and fully leverage secret sauce. In our view – secret sauce -- “that certain something” about a potential target company, can best be understood through the lens of operating model and business model.

When an acquirer deconstructs its prospective deal thesis, due diligence findings and integration strategy to the level of crystal-clear understanding of the target company’s operating model and business model. It can be assured that it is adequately prepared to make mission-critical deal or integration decisions.

Some Examples Please?

This may sound somewhat like nailing Jello to the wall, so let’s look at some actual examples taken from recent client engagements. These examples will help provide a foundational awareness for the types of organizational capabilities that rose to the level of a real secret sauce and help your team “know it when you see it” in future deals.

- The Inside Sales Secret Weapon. The Buyer was a large, global software provider whose solutions were primarily legacy enterprise software solutions. As the Buyer had done throughout its history, its solutions were sold to major companies by a National Accounts Team, and a Product Accounts Team via a long-term enterprise license. In this deal, the target company (TargetCo) was a $100M SaaS-based provider in an important new market segment in which the Buyer had relatively little expertise or legacy solutions. During due diligence, several essential observations were assembled from the various functional due diligence workstream findings. By mapping these through a business model canvas exercise, the secret sauce was shining out like a beacon. In this case, the TargetCo’s secret sauce was the power of the inside sales engine it had built which enabled it to more quickly and less expensively, land initial installs, then carefully cultivate solution adoption and deployment. The systems component driven by a highly effective and customized internal sales knowledge base and CRM heavily adapted from the third-party provider. The most coveted and highly compensated roles in the organization were the senior inside sales engineers who were teamed with a dedicated customer success manager with a detailed program plan, training solution and passionately loyal user community that together, created a unique and distinctive ability to bridge initial client demos to long-term and successful deployments. Remember that secret sauce is always a combination of elements intertwined to create a true distinctive, competitive advantage. Accordingly, there were other supporting operating model elements including a culture that valued, celebrated, and rewarded successful customer deployments and teamwork.

- The Secret to “Super-Quants” Career Success. The Buyer was a large, diversified financial services provider active across many industry verticals. The TargetCo was a uniquely talented boutique that had developed an amazing and highly proprietary capability to identify and attribute actual account openings and actual dollar deposits derived from specific marketing campaigns. Throughout its history, the TargetCo had recruited “super-quants” (e.g. highly, highly gifted quantitative brainpower) exclusively from the top Ivy League schools. Now before you lose interest in this story as “nothing special, anybody can do that” let’s click down a level. Over time, the Buyer learned that the sheer brainpower of these super-quants was worse than useless without three secret weapons the TargetCo had meticulously crafted and perfected over time, that combined were the true secret sauce. First, was a rigorous team-based interview model that relied heavily on the other super-quant employees to determine chemistry, fit and validate the potential for hire. In short, to confirm whether this candidate is someone we would enjoy working with and benefit from. Second, it was an incredibly comprehensive mentoring and training program that enabled the new hires – literally over a period of years – to learn, work with role models, practice, and ultimately perfect; the highly complex analytics and interpretation that propelled the company’s core value proposition. Two other essential components stood out to us in this case. A senior leadership team that the super-quants desperately WANTED to work with and for. This was based not just on the leader’s analytical brainpower, but on their integrity, down-to-earth manner, and world-class industry credentials that made this boutique a truly sought-after employment destination. And finally, a high-performance culture that embodied (read that as “demanded”) outstanding customer service and attention to detail at every step of the client journey to ensure client success and loyalty.

So, what is secret sauce and why should your company care? We like this definition: “a unique combination of talent, processes, systems, finely-tuned expertise or “know-how” and culture. Combined effectively to create a distinctive organizational capability or competitive advantage.” You typically won’t find secret sauce neatly categorized in a virtual data room or highlighted in the management presentation deck for your deal team. When it comes to acquiring, preserving, and leveraging secret sauce, you have to do more than just talk about it. You have to know what to look for, what to do with it when you find it (or if you don’t), and most importantly, what to do with it during integration.

So, what is secret sauce and why should your company care? We like this definition: “a unique combination of talent, processes, systems, finely-tuned expertise or “know-how” and culture. Combined effectively to create a distinctive organizational capability or competitive advantage.” You typically won’t find secret sauce neatly categorized in a virtual data room or highlighted in the management presentation deck for your deal team. When it comes to acquiring, preserving, and leveraging secret sauce, you have to do more than just talk about it. You have to know what to look for, what to do with it when you find it (or if you don’t), and most importantly, what to do with it during integration.

Editor’s Note: Look for the next article in this series, coming soon, “Secrets for Preserving and Leveraging Your Target Company’s Secret Sauce.”

_________________________________________________

About the Authors:

Mark Herndon is Chairman of the M&A Leadership Council. He specializes in a broad range of strategic and business effectiveness initiatives.

John Bender is the President of M&A Partners and has more than 20 years of experience as a high-tech business transformation executive and is known as an innovative & decisive executive with a passion for winning in the market.