Get ready, get set…Go!

This phrase conjures up images of a foot race, with “get ready” prominently reflected as a critical step in the process. It also invokes visions of a marked starting point and runners racing against time.

M&A work is often a race, and how ready you are can determine the result at the finish line. In order to be prepared, a company must have its M&A house in order – meaning, its M&A methodology is well understood; its M&A team skilled and ready to go; and its policies, processes, practices and tools locked down. This is especially true for Human Resources (HR).

M&A presents significant challenges for HR that must be managed. Getting it right for HR means that it must contribute strategically to M&A success by ensuring the people strategy is aligned to the deal and business strategy, ensuring all impacts to the employees are considered and handled with respect, care and attention. It is an area that touches so many facets of the employee and customer experience that even getting one element wrong could have serious implications on success. From compensation, retirement, and health/welfare evaluations, to talent assessment and selection; from culture assessment to communication – the scale and length of HR’s M&A influence and reach is undeniable.

Human Resources is one of the most critical functions to get right when it comes to M&A. A recent report, “People Issues in M&A Deals” (Ernst & Young 2019), stated, “85% of failed acquisitions are attributed to poor management or insufficient planning of people issues.” There is no other function whose contribution has such a high impact on deal success. HR must be ready early on to ensure success. The get ready part of the equation is critical, and this step alone, if done correctly, can reduce the failure rate.

So what does HR Readiness mean? What specific activities does the HR department need to do to ensure M&A readiness? Perhaps the first and foremost step is to assess the team’s M&A capabilities and experience:

- Does the HR team have the HR M&A competence including knowledge, skills and experience necessary to be successful in deal execution? This is particularly important for those who will be leading the overall HR deal efforts or the various HR workstreams during the various deal phases.

- Do these individuals know and understand what their M&A role responsibilities are and, most importantly, what is expected of them?

- Do these individuals have the ability to identify opportunities and risks early on, quantify the liabilities, determine resolutions and, most importantly, have the gumption to influence Senior Leadership to act?

If the answer to any of the above questions is “no,” then it is imperative for HR Senior Leadership to ensure the proper education and training is provided to close the knowledge and skill gaps. This training can be offered through internal channels (such as M&A mentorship and formal learning programs if M&A expertise resides internally within the organization) or through seeking out external M&A expertise and training programs through such organizations as M&A Leadership Council, M&A Partners and other M&A training/consulting firms.

The second critical piece for HR Readiness is what I call the foundational elements. These are the pillars upon which the other components get built. If you do not have your foundation in place, no matter how sturdy of a structure you build, it will be susceptible to failure. The foundational elements are what support the direction, the size and the pace of the build. Or in M&A language, these foundational elements help set the directional blueprint, proactively identify and remove potential obstacles, mitigate early risks while allowing for increased real-time deal pace.

- Adopt HR Guiding Principles. Every HR department entering into M&A activities should have a set of guiding principles to act as the department’s North Star at deal time. An example of a guiding principle might for all acquisitions, employees will be put on the buyer’s payroll rather than staying on the targets. Another principle might be that every acquired employee will be given a new offer letter. These principles do not need to be complicated, but they do need to be thought out in advance of a deal. As an M&A readiness exercise, every HR department should review their current policies, programs and practices to determine if any principles with M&A significance should be developed. Creating and agreeing to these principles before a deal allows for less confusion, frustration and indecisiveness at deal time.

Other HR Guiding Principles should include establishing or refining your company’s retention strategy through the lens of M&A. Creating or re-examining the company’s severance policy is also a smart readiness practice, but perhaps one of the most important is the creation of an HR M&A Decision and Escalation Matrix. This provides the HR team members with an agreed upon process to quickly raise issues that are outside of the standard policy, process, etc., to get to decided quickly. It takes the guesswork out of who needs to approve what, especially when quick decisions and the right level of approval matter.

HR Guiding Principles are meant to help shepherd activities, but it is important to remember that each deal is unique, and the Guiding Principles should be reviewed to ensure they are tied to the specific deal’s business goals and related strategy.

- Establish an HR M&A Governance model and methodology. This allows for a rapid start for the HR M&A team. The Governance model should indicate what the HR structure will be to support M&A work, designate who will be responsible for what roles and ensure those roles are clearly defined.

In addition, the governance model should also clearly identify where the cross functional and other related interdependencies are and visibly identify who is responsible, who is accountable, who is the sponsor, who needs to be consulted and who needs to be informed (RASCI). Having all this decided and agreed to prior to a deal will ease and quicken the process while helping to eliminate friction between various parties causing HR’s deal pace to be affected. An example of a critical interdependency process that may occur in Due Diligence for some organizations is the relationship between Legal, Total Rewards and Finance in reviewing various executive compensation, equity and retirement plan documentation and the financial evaluation of those plans. For some organizations, this may occur in-house; for others, it may mean reaching out to external vendors. Either way, it is important for HR to have a clearly defined and agreed upon process well ahead of deal activity as in the eyes of the organization, HR owns the outcome.

- Map the various HR business and systems processes. These could include such things as how and when an employee ID gets created and how it fits into the sequence of steps required to get an employee into the buyers’ HRIS. For some companies, this sequence could be fully generated by one system; at others, there could be several platforms that are involved and therefore have various touchpoints within the process. Understanding and documenting these sequences, dependencies and activities will go a long way to help ensure nothing falls through the cracks later.

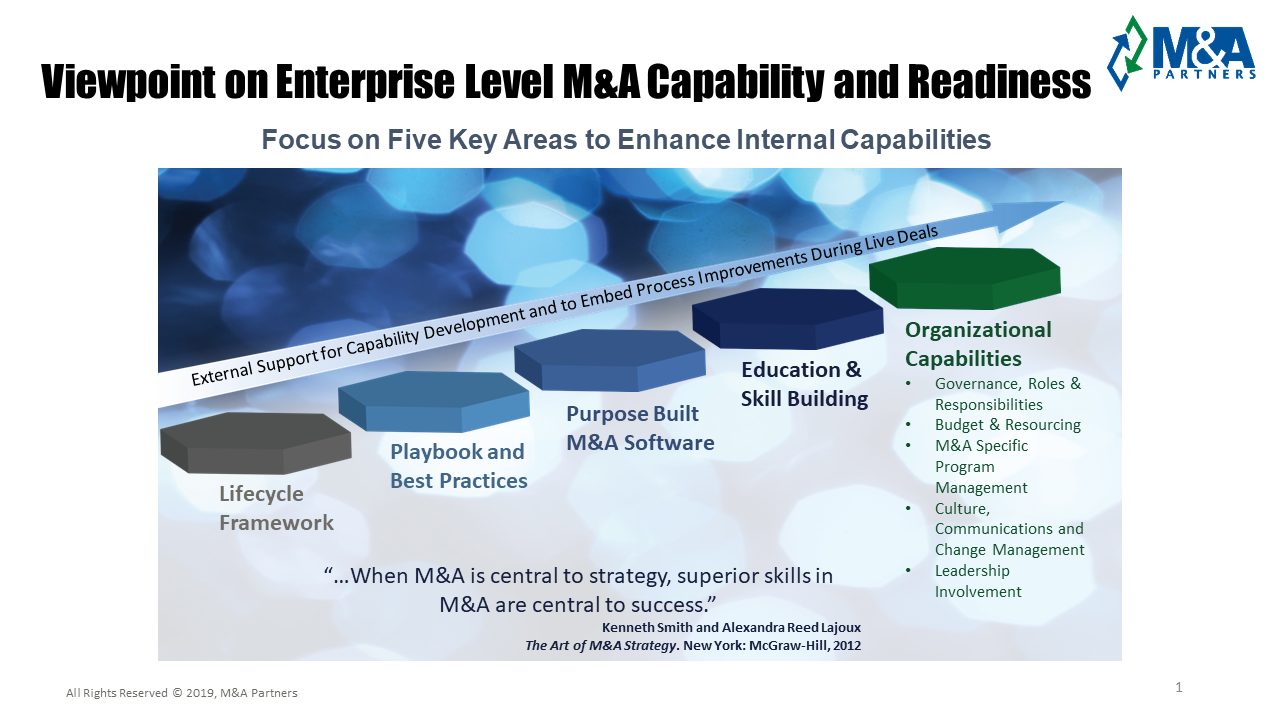

Once an HR department has the foundational elements determined, the next phase of readiness is to align the people objectives and activities to the various phases of the deal. This is called creating the HR M&A Lifecycle or Roadmap. The HR Lifecycle should always align with the broader organization’s “Enterprise M&A Lifecycle.” Each of the various workstreams within HR should also have their own roadmap that outlines their specific accountabilities and activities during each of the deal phases. To support both the HR functions and the various workstreams, a number of associated tools and templates should be created – Due Diligence request lists, RAID (risks, actions, issues and decisions) log and data capture templates, to name just a few.

The Lifecycle will become part of the larger HR Playbook. Each organization’s playbook is unique and includes some or all of the foundational elements outlined above. In addition, the Playbook should include how-to instructional modules for key deliverables; a standard set of master tools and templates; relevant samples from prior deals; and a resource library. The Playbook should also be digital compatible so that it can easily be incorporated into fit-for-purpose M&A software or document repository such as SharePoint or ShareFile. Playbooks are an essential resource for HR M&A Practitioners, and although the creation of a playbook is part of the readiness process, it should be noted that for some components, content may need to wait until a live deal is taking place. It is also important to include post-deal lessons learned in the resource library.

As strategic partners to the business, HR has a critical role in achieving M&A success by getting the company ready for that success. Being M&A ready underpins a strong M&A race before the “Go” on a live deal is sounded. As Benjamin Disraeli, UK Prime Minister, back in the mid to late 1800s said, “the secret to success is to be ready when the opportunity comes.” This remains timeless advice.

Wendy Parkes is a Senior Partner at M&A Partners and has over 30-years’ experience as an HR Professional in the U.S., Canada, Europe and Asia in the financial services industry. Don’t miss your chance to see Wendy present at the M&A Leadership Council’s The Art of M&A for HR Leaders in Boston September 2019! This workshop-styled program includes case studies, breakout sessions and panel discussions, along with ample time for networking with presenters and colleagues.