Companies, their customers, and their stakeholders cannot and will not tolerate an integration time frame of more than 12 months, period. If you can’t integrate in 12 months or less, forget it!

Many companies consistently operate in the intuitive mode of “don’t rock the boat”, “let’s take our time with this and give the organization time to adjust,” “let’s get everything right the first time.” Haven’t you heard that before?

The fact is that time kills synergies, erodes customer confidence, and destabilizes the organization. The intuitive approach does just the opposite of what is intended. It actually destroys value. Speed is the driver of value. Often a good decision made quickly is far better than the perfect decision that takes too long. Rapid implementation is the end result of the right Integration Team Structure, Early Detailed Planning, and an Unrelenting Focus on Speed.

Speed first came to everyone’s attention in the 1990’s when Jack Welsh at G.E. made speed the foundation for the company’s integrations. Today it is a fundamental concept for integration excellence.

Companies who are building core capabilities in M&A have learned that “cycle-time” is just as relevant to M&A and especially the integration phase as it is to other critical business processes. Let’s take synergies for instance. The goal for all synergies should be to collapse the cycle-time (beginning to end) to achievement. The faster you can capture a synergy, the greater the incremental impact to cash flow.

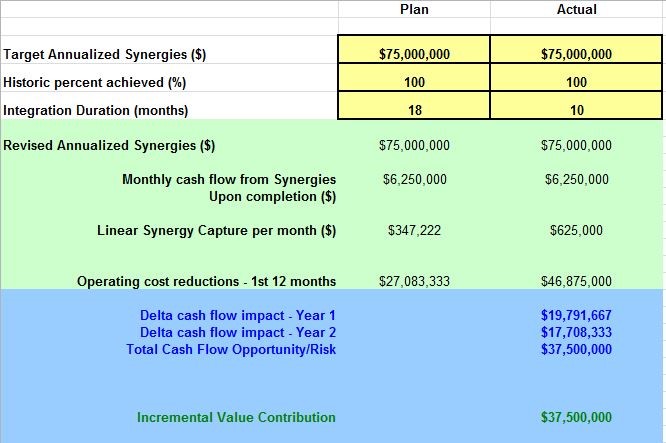

See the actual outcomes below:

What the above true example shows is that by achieving the forecast synergies in ten months rather than the 18 months that were initially planned, speed contributed an additional $37,500,000 in one-time cash flow.

Speed affects everything. The faster you can take advantage of synergies and complete the integration, the faster you stabilize your customers, employees, shareholders and everyone and everything else affected by the transaction.

Of course everyone knows that speed is achieved when an organization has multiple cycles of experience added to a rigorous planning process and unrelenting leadership with full transparency into all the actions, issues and metrics needed to guide the organization.

In my last two articles in this series I talked about the great value in the certainty that an acquisition will be successful. But, most are not. The Street places greater value on deals that have a history of successful integration and subsequent cash flows. Certainty comes from multiple cycles of experience repeated through full time resources using well documented playbooks and tracking tools. Deals absent these things will have no certainty for success.

I also discussed the importance of value preservation vs. value creation and that much more focus needs to be placed on the things that preserve the value of the deal. And, since most deals begin to lose value on the day of announcement and will often continue to lose value until the integration is complete, it is imperative that a company and its integration team have created a value preservation strategy before considering a value creation strategy.

Assuming that you have the trained resources operating with well documented processes and tracking tools and that your organization has developed a good value preservation plan for the integration……..it’s time to focus on Speed. Effective merger integration is waged like a military strategy: Quick effective decision making, discipline, command and control on top of rigorous planning. Speed often is the value.

Photo: coaching-ab.com

______________________

About the Author: Jim Jeffries is the founder and Chief Executive at M&A Partners. He has held C Level positions in multiple consulting companies and industry. Mr. Jeffries’ background includes P&L responsibility at various size organizations during multiple stages of growth. He is also a CEO coach and advisor in global leadership development. His particular strength is in creating organizational vision to stimulate revenue growth while optimizing returns on invested capital. He has been quoted extensively in USA Today and in recent releases of The Art of M&A book series published by McGraw Hill.