Building the Case for Your Integration Management Office

By Mark Herndon, Chairman of the M&A Leadership Council

We’ve always believed that M&A success is “top-down strategy-led process highly dependent on superb, bottom-up integration program management, planning, and execution.” To address that topic, we recently assembled an all-star panel of M&A professionals to discuss the Hidden Heroes of the Integration Management Office (IMO). During our discussion, the panelists shared their answers to challenging questions about what leading acquirers are doing right when it comes to establishing and operating the all-important role of the Integration Leader and Integration Program Manager — the heart of any successful IMO. We know their insights will resonate as your organization works to continuously improve your internal M&A capabilities.

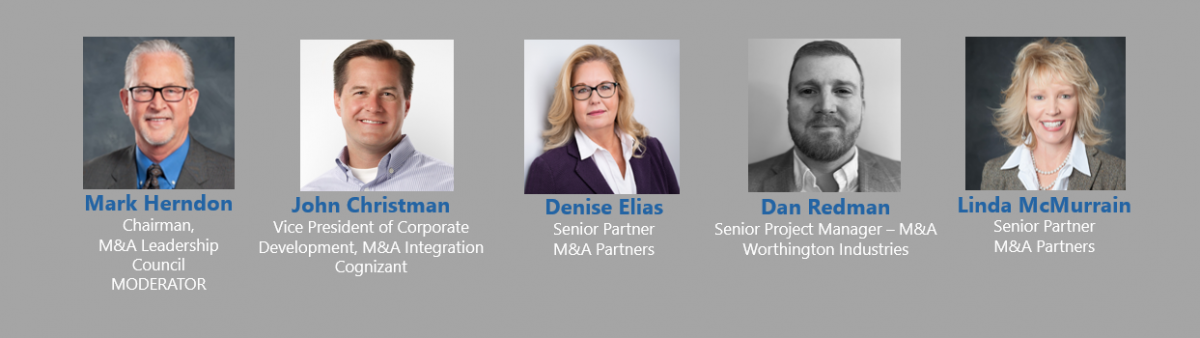

Meet our all-star panel:

Q: How do you establish the business case and the return-on-investment of the Integration Management Office (IMO)?

A: (John Christman, Dan Redman)

Successful serial acquirers understand the value of the IMO. They know that if you want to do multiple deals a year, you’ll need a sustainable, repeatable process to make each deal successful.

Your business case for the IMO should include the following points:

- Think of the IMO as a necessary investment to achieve the ROI for the deal — or the overall portfolio or the M&A strategy, if you're going to do multiple deals. All business cases include one-time integration costs, just like systems integration requirements, key employee retention costs, or capex and working capital required to capture essential strategic initiatives. The IMO is another required investment the company will need to ensure a successful acquisition.

- The IMO is a key enabler to achieving better synergy capture, whether it’s growing top-line revenue synergies or achieving cost saving synergies on the bottom line. The right kind of IMO and IMO leaders / program manager works as both a catalyst and an insurance policy for deal synergies. As a catalyst, their job is to help validate, plan, accelerate and fully execute synergies with a value-first mindset. As an insurance policy, they are the best friend to Corporate Development and the Executive Team to ensure robust accountability and focus to hit the deal’s key objectives.

- A key benefit of the IMO is risk remediation and mitigation. A skilled and experienced IMO is going to be able to see around the curves in the road and quickly address potential risks, issues, action items or decisions needed (RAID) that would otherwise almost certainly fall through the cracks. Once you have a standard playbook and an experienced, dedicated team that goes from deal to deal, you’ll be able to anticipate more and more of the common risks or pitfalls and proactively navigate around them. That continuity of expertise and “lessons learned” are key elements for investing in dedicated FTE resources comprising the IMO.

- It’s important to keep in mind the value erosion that happens quickly after a deal is announced. One of the best ways to shorten that time period is by having a better plan and having somebody dedicated to managing that plan from deal to deal. You do that by driving superb pre-announce, pre-close and pre-cutover planning and execution, which lead to successfully navigating every deal’s highest risk stages and milestones. If each deal is managed by different groups, you don’t get the benefit of continuity. There’s no one available or accountable who can say, “I’ve seen this before. I know what to do here.”

- And finally, the stabilizing presence from an IMO gives you a little bit more flexibility to stretch people on integration-related assignments at the functional level. Where the rubber meets the road in an acquisition is when the resources in each functional area meet with their counterparts and understand how to transition. Even if the IMO is not as experienced in the process, they are still needed to guide others in effectively managing that transition. One of the best things we’ve done is to provide IMO expertise to coach and advise the functional workstreams in their respective challenges, dependencies and work plans. If your IMO can do that, you are getting to the level of world class, and both functional and cross-functional results will really kick into high gear.

Q: So how do you quantify this information?

A: (John Christman, Dan Redman)

Well, it's not easy. And it's not perfect.

But you can model it out from a synergy capture perspective. For example, you can project that the cost synergies of the deal will start at a certain date. But if the expertise of the IMO can make it happen six months sooner, or perhaps achieve 80% of the deal thesis to completion in year-one and up to 120% of deal synergies within two years, you can make a case based on the value of that time and money. That’s worth something. And you’ll have something tangible to present to the CFO.

Q: How is the IMO structured differently between larger global acquirers and smaller companies?

A: (Denise Elias, John Christman)

It's probably no surprise that larger serial acquirers have a bit more infrastructure in place than smaller companies. The big difference is in dedicated resources, especially for those who routinely make acquisitions.

For example, a large acquirer may have a dedicated IMO function and a few dedicated M&A roles in key corporate functions such as HR, Finance or IT. Those are typically the big three, although some organizations may have them throughout other functions as well.

But a smaller company would not necessarily have all that infrastructure. Instead, the default position for smaller companies is “side-of-desk or in addition to an already intense day job.” Frankly, that never works. Even if it is an ad hoc, one-time project role, smaller companies would be much better off pulling in someone who's run large Enterprise Resource Planning, program management offices or something similar to handle the integration leader and program manager responsibilities.

Either case benefits from not only internal resources, but external as well. For larger companies, it’s often practical to build the internal expertise to a point and supplement with external help for peaks or uncharacteristically busy times. Or they may need the extra hands for one really large deal.

With a smaller deal or a smaller company, external resources may be necessary more as advisory roles. Because internal resources haven’t had the opportunities to participate in multiple deals, the smaller companies are more likely to need experts to walk them through the deal and help them develop their own processes. Integration success is heavily experienced-based, and you never want to throw someone into one of these roles to try to learn on the job — the risks are just too great.

Q: How do you staff the IMO team to accommodate fluctuations in deal count and timing?

- (Denise Elias, John Christman)

Whether a company is a serial acquirer or only doing a couple of deals per year, it’s important to at least have an established IMO that has some continuity, and a few program managers who have done acquisitions before. In an acquisitive company that is medium to large in size, you’ll want to make sure you have a fully staffed IMO that is able to handle multiple, concurrent deals.

When you start to get larger volumes of deals, you’ll need to ramp up your staff to the activity that you'll be dealing with. This can be done in two ways:

- Get involved with corporate development early in the lifecycle to make sure you have budget to hire the staff you need, and advance awareness of the deals in the pipeline so you are ready to deploy immediately.

- If you don't want to staff internally, consider using the same dedicated outside resources on multiple deals to ensure they have adequate organizational context and history with your company. This will also maintain that experience and continuity between deals.

If there’s any downtime between deals, your internal IMO team can add value to the organization by participating in other cross-functional projects, such as change initiatives, systems implementation, strategy execution, and contingency planning.

Q: What are the biggest challenges when trying to launch your IMO?

A: (Dan Redman)

When you think about M&A integration as a whole, a lot of it comes back to change management. The same is true when you're starting up a new function, such as an Integration Program Manager or even the entire IMO — it's largely change management.

Previously, these professionals may have worked on an acquisition for a particular functional area, but they didn't have a firm governance structure or a dedicated accountability manager inquiring about their status. Suddenly, they've got somebody constantly asking them, “How’s it going? When's it going to be done? What risks or issues do we need to be working on next?”

That can be challenging. Successful IMOs must add value to the deal and to every constituent group in the integration — especially to corporate development, the executive team and the functional work-streams. The role can never just be “checkers checking checkers.” It really comes down to the IMO’s ability to plan, accelerate, provide visibility and accountability across the entire program, as well as bridging the gap when you see potential risks or issue. That requires a core understanding of the entire organization, its business, the work plans and the functions.

And most importantly, that requires trust — both your trust in the workstream leader’s expertise and their trust in you to help drive success across the entire program by solving problems, informing, communicating and being the eyes, ears and “conscience” of the overall integration. If there’s a gap, ask them to help you understand what they're doing and why; where it adds value; and how it can have such a huge impact on the success of this integration.

That's really where the key to success is — building those relationships. Help them understand that you’re not there to micromanage them: you're there to learn and add value. And make sure that if they win the lottery the next day, you’ve still got someone who knows enough about what they do to continue being successful.

____________________________________________________________________________________________

Join us next month as we continue the conversation with Hidden Heroes of the IMO, Part 2: IMO Leaders and Program Managers. You may also enjoy watching the full panel discussion, The Hidden Heroes of the IMO: Superpowers and Abilities of Integration Leaders & Program Managers, on our website.

The M&A Leadership Council has trained over 4,000 executives from over 700 best-in-class organizations. We look forward to seeing you at one of our online training events or webinars soon.