Preserving and Leveraging Your Target Company’s Secret Sauce

By Mark Herndon, Chairman of the M&A Leadership Council and John Bender, President of M&A Partners

One of the most important concepts in integration strategy, planning, and execution is “Secret Sauce.” These critical capabilities – the elements that make the TargetCo distinctly strategic or valuable in the first place – must be carefully analyzed, retained, and leveraged during integration to fully realize the planned business results.

One of the most important concepts in integration strategy, planning, and execution is “Secret Sauce.” These critical capabilities – the elements that make the TargetCo distinctly strategic or valuable in the first place – must be carefully analyzed, retained, and leveraged during integration to fully realize the planned business results.

As defined in our prior article in this series, That Certain Something that Makes Them Unique, secret sauce is comprised of those distinctive attributes and capabilities that form a real competitive advantage and likely prompted at least part of your intent to acquire them. While this concept is easy to talk about, it’s much harder in a live deal to make the TargetCo’s secret sauce a viable part of integration strategy decisions -- harder still to plan and execute integration actions that don’t quash or spoil much of the Target’s pre-deal magic.

We see three principal risks for executives and acquiring companies when dealing with the TargetCo’s secret sauce. These include: 1.) An incomplete or inadequate understanding of what it is; 2.) Failure to embed the concept of secret sauce and the skills for dealing with it in the core internal M&A process lifecycle and capabilities of the buyer; and 3.) Specific integration decisions, plans or objectives that are adopted without regard to their potential impact on TargetCo’s secret sauce. (Editor’s Note: Risk #3 will be featured in the third and final installment in this series.)

Secret Sauce Risk #1 – Incomplete or inadequate understanding. To help level-set your organization on the importance of a correct definition of secret sauce, we must emphasize the fact that it is not a single attribute or element --whether system, data, talent, processes, unique know-how or in-depth experience, etc. but the complex combination of many of these attributes combined into a distinctive overall capability realized in TargetCo’s operating model. That combination of attributes is precisely what creates the distinctive capability and thus the TargetCo’s strategic advantage that your organization likely paid a risk-adjusted premium to capture. Unfortunately, the fact that secret sauce exists as a complex, highly intertwined capability “system” is what makes risks #2 and 3 essential to get right.

Additionally, it takes seasoned function leaders to decompose and understand TargetCo’s capabilities and develop integration plans that achieve the desired future state without material impacts to secret sauce. An inflexible application of “Adopt & Go” in favor of the Buyer’s operating model as the direction for future state—regardless of deal strategy—is almost certain to cause value erosion.

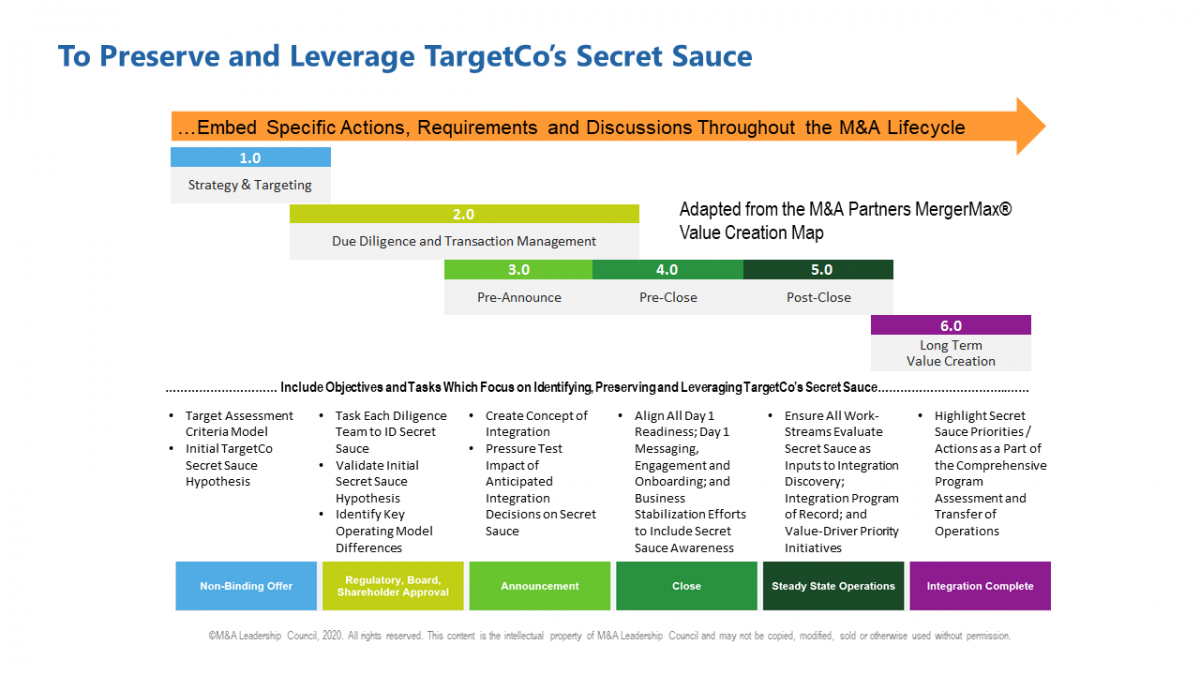

Secret Sauce Risk #2 – Failure to embed secret sauce into your internal M&A lifecycle and skill set. A fundamental requirement for getting good at M&A is thinking about and executing it not as a one-off event or transaction, but as a documented and effective business process for growth. A generic M&A lifecycle model we frequently instruct during various M&A Leadership Council executive training programs is based on the M&A Partners MergerMax® Value Creation Map. While this is generally applicable to most industries, acquirers, and deal-types, we believe it is important to adapt the overall process to your situation and typical acquisitions. That said, let’s use this generic six-phase model to illustrate how your organization could consider building secret sauce and the skills for dealing with it into the fabric of how your organization “does M&A.” As with many cross-functional and multi-disciplinary processes like M&A, we believe most organizations can realize tremendous value from one or two practical enhancements to each process phase, briefly illustrated below.

Phase 1 – Strategy & Targeting. Most sophisticated acquirers have a defined TargetCo assessment model whereby corporate development or other key strategy-oriented executives routinely profile potential acquisitions based on pre-due diligence level data derived from trade knowledge, publicly available data, and research. Threshold criteria are established in a variety of categories: strategic fit, product/service offerings, and gap-fill potential, market and competitive positioning, financial performance, etc. Start forming a hypothesis now concerning a potential TargetCo’s distinctive secret sauce. Document that hypothesis in your overall target assessment criteria model and use that to potentially elevate one TargetCo relative to another. Use the hypothesis as a basis of discussion with the CEO or deal-team of the Target to begin discerning the validity of your hypothesis and factor that into your decision to continue or drop the pursuit.

Phase 2 – Due Diligence & Transaction Management. Commonly accepted practice is launching each due diligence process with a comprehensive internal diligence team briefing about the TargetCo, the deal-thesis or strategic intent of the pursuit, and rules of engagement or protocols used during the diligence process. This briefing should ideally include your preliminary hypothesis about the secret sauce. Each diligence team should be tasked with looking for validation of the secret sauce hypothesis and talking with their TargetCo counterparts about their views of secret sauce – and the attributes or components responsible for driving and sustaining the secret sauce. Additionally, each due diligence team member should be looking for key operating model differences that may be foundational for TargetCo’s ability to deliver value to customers, employees, and other stakeholders.

Phase 3 – Integration Pre-Announcement. We’ll address this phase lightly but refer you to a recent article (Do This Before Launching Your Next Integration). It outlines our views of what to consider and potentially decide – at least at a preliminary “guardrail” or assumption level. In sum, diligence findings should be considered when assembling a detailed outline of directional decisions for integration, often called the Concept of Integration. A key part of this analysis should be confirmation of potential secret sauce and a careful “pressure test” of preliminary integration decisions (systems, processes, commercial considerations, organizational implications, etc.) specifically against identified secret sauce elements. If a potential integration decision has a high likelihood of negatively impacting a secret sauce capability, leadership can revisit the decision, timing, or implementation and change management requirements accordingly.

Phase 4 – Integration Pre-Closing. The main priorities in this phase are planning and preparing for seamless Day 1 operation. Your messaging, engagement and onboarding of acquired employees; as well as your business stabilization efforts, all must work in advance to mitigate potential unintended consequences of the deal or its closing on employees, customers, partners, vendors and other key constituents. Similar to the executive steering committee “pressure test” on secret sauce impact during Phase 3, planning and preparations for all Day 1 requirements, messaging, onboarding and business stabilization, must be conducted with a series of ongoing verifications against unanticipated secret sauce impact, this time, by all key business, functional and integration leaders involved in the Day 1 readiness effort.

Phase 5 – Integration Post-Closing. Two of the most important aspects of preserving and leveraging your TargetCo’s secret sauce occur in this phase. Whether your company typically starts joint-integration planning prior to closing (ideal, whenever possible!) or not until immediately post-close, each integration work-stream should be tasked with completing a comprehensive Integration Discovery analysis and report-out. This structured process ensures both Buyer and TargetCo integration and work-stream leaders build on the diligence findings by exploring specific operating model, organizational, process, system, data, talent, and culture elements - the building blocks of secret sauce -- then collectively “come to shore” on the best potential approaches for sustaining and scaling the truly distinctive attributes in the “Newco” context and environment. Similarly, the outputs of this exercise directly inform and drive creation of the Integration Program of Record, Value-Driver Priority Initiatives, key milestones and other comprehensive integration plan components.

Phase 6 – Long-term Value Creation. A common challenge for every acquirer is defining what will constitute “integration complete”-- then transitioning the remaining long-term value creation initiatives to the owning businesses or functions while continuing to focus and execute on the “long-tail” strategic systems, commercial, organizational and leadership priorities. Like the prior phases, secret sauce components should be considered part of a comprehensive assessment and transfer of operations.

_________________________________________________

About the Authors:

Mark Herndon is Chairman of the M&A Leadership Council. He is co-author of The Complete Guide to M&A Integration: Process Tools to Support M&A Integration at Every Level, now in its third edition (Jossey-Bass, 2014); and a frequent presenter at the M&A Leadership Council executive training programs.

John Bender is President of M&A Partners and has led or supported nearly 50 acquisitions, mergers and divestitures spanning every aspect of the M&A lifecycle with industries including: software and technology, bio-tech/clean-tech, energy, transportation and environmental services, among others. He is widely recognized for his key role as Executive Director of Merger Integration in Hewlett-Packard’s $19.5B acquisition of Compaq Computer.