The Story of the 2-Day TSA

By Mark Juergens, Senior Partner, M&A Partners

Over dinner one night during a recent client engagement, the Vice President of Corporate Development leaned forward across the table, and as if whispering a stock tip, asked, “What is the fastest you’ve ever developed a transition services agreement (TSA)?”

It was no stock tip, and no joke.

He was dead serious, and frankly, he was caught between the proverbial rock and a hard place. Their deal had languished for weeks while pushing through very complex deal terms. When the breakthrough came, they were caught flat-footed.

The only thing worse than not having a completed and mutually agreed TSA ready for closing, would be trying to negotiate one post-closing! So, we got to work.

Here’s the story of how we developed the “2-Day TSA.”

Unchartered Waters. Generally speaking, when a buyer and seller have signed a non-binding Letter of Intent (LOI) to purchase a carve-out business unit via an asset purchase agreement (APA); completed due diligence; and subsequently reached material agreement on key deal terms; one of the next most important definitive documents to develop is a transition services agreement.

Whenever a Seller desires to shed a non-strategic business unit, division, plant, product line, etc., the Buyer must literally “carve-out” the to-be divested asset from the Seller’s remaining organization, systems, processes, applications, and often, from a highly complex, intertwined shared services environment. Upon closing, whatever systems, applications, services or processes the Buyer cannot stand-up and seamlessly operate immediately upon transfer of ownership, the Buyer typically purchases these services from the Seller for a period of time.

Unfortunately, the devil is always in the details and TSAs typically bedevil both Buyer and Seller. While Buyers typically want very detailed and specific TSAs by function, sub-function, system, process, and service to be provided, all matched to specific line-item costs and defined time periods, Sellers often want the opposite.

Challenging dynamics and conflict often ensue as the gap between what the Buyer thought was to be provided and what the Seller is actually going to provide becomes as pronounced as the Grand Canyon. One client, a highly sophisticated global acquirer, recently commented, “We started out our TSA as best friends and business partners, but quickly ended up in all-out trench warfare.”

But our situation was even more challenging than the norm. Both corporate development teams were frequent acquirers, but neither had direct experience with a carve-out asset purchase or TSAs. The Seller’s operating model was highly centralized, with extensive and mature shared services and a high degree of process automation and employee self-service.

The Buyer’s? Let’s just say it was the “polar opposite.” As a result, we could foresee the likely need for a very comprehensive, long-term TSA.

Further, so much time had lapsed getting to principal deal terms, there was now immense pressure from the Buyer’s executive team to quickly close a deal. Unfortunately, the Seller suddenly turned cautious and slowed the process once again as they assessed potentially overlapping customer contracts between the business unit to be sold and the Seller’s core, corporate customers.

No Playbook for That. Even among highly experienced acquirers, carve-out acquisitions or divestitures via an APA with a comprehensive and well-developed transition services agreements are often not part of the standard playbook. As one best-in-class acquirer commented, “We’d done over 200 acquisitions when we did our first-ever divestiture, and unfortunately, we learned the hard way that divestitures are NOT spelled ‘n-o-i-t-i-s-i-u-q-c-a’ (e.g. ‘acquisition backwards.’)”

With no time, no playbook and no prior experience, frankly, there was also no way to develop an effective TSA with the typical unilateral, iterative process laden with consultants and lawyers, where one side develops a draft and throws it over the transom for the other side to shoot holes in. We had no choice – there was simply no other way to gather post-closing requirements from both Buyer and Seller, then quickly scope, draft, price, and negotiate binding TSAs; much less, fully prepare to operate the TSA’s before closing. We had to innovate.

Can you build a TSA in two days?

The decision to use a joint planning workshop to develop the TSA was the easy part. Both Buyer and Seller realized there was no other way. Planning the myriad of approvals, logistics, schedules, process instructions, deliverable templates, etc. was the hardest part, and simply wouldn’t have come together without the herculean efforts of Buyer-team, Seller-team and consultants all working feverishly together.

Based on that degree of planning, however, running the TSA Development Workshop was a blast. As the Seller’s Integration Lead commented, “as soon as our function leads and workstreams were engaged together with their counterparts, you could feel the entire deal pick up enormous speed. We are going to get this deal done!”

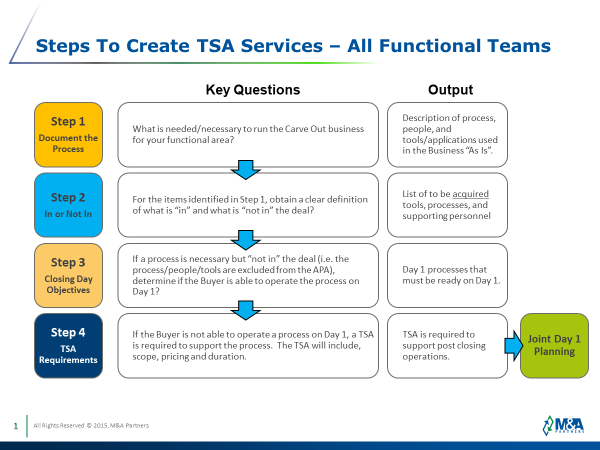

Figure 1, The 2-Day TSA Workshop Model, illustrates the core approach we asked each workstream to undertake on the first day of the workshop. In a traditional acquisition, this level of analysis and interaction would often take place over several days or weeks during a step we like to call “Integration Discovery.” We “cycle time compressed” this to primarily occur in two days by intense preparation of each workstream in advance and robust facilitation and note-taking during each workstream break-out and running multiple workstreams in parallel.

Key Lessons Learned Include:

1. Determine a Leader - Typically, the Seller leads the process to draft TSAs because they have a better understanding of what is essential to operate the business. In some deals, the Seller may be inexperienced in carve-out divestitures and they may not have the experience to draft TSAs. In this situation, the Buyer may need to step up and lead the process, effectively identifying and articulating, “here’s what we are going to need – will you do that?”

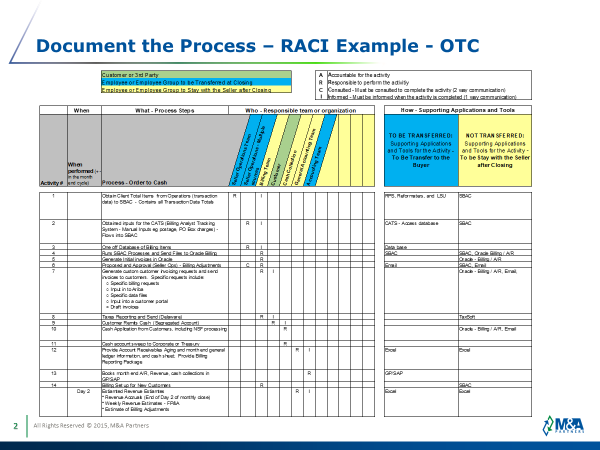

2. Document the Processes - Develop an approach to collect and document the “As Is” processes used by the carve-out business unit. In summary, you need to document for each key process (e.g. Order to Cash, Procure to Pay, Hire to Retire, etc.)

i. Process - The key processes and flows used by the business;

ii. People - List the people or teams that perform each process step;

iii. Supporting Applications - List the supporting applications used to execute the process steps (e.g. ERP, Excel, external cloud software vendor, etc.)

There are many approaches to document processes, people and supporting applications. A RACI template (e.g. Responsible, Accountable, Consulted, Informed) is a well-known approach to document “As Is” requirements.

3. What’s In / What’s Out / Stand up on the Closing Date – Using the documents in the previous step and in consultation with deal leadership, determine what processes, people, and supporting tools will be transitioned to the Buyer at the Closing Date, and what will remain with the Seller. Also, determine which processes the Buyer has time to stand up by the Closing Date and therefore will not require assistance from the Seller after closing.

4. Draft TSAs - Armed with the information above, draft specific TSAs that will fill the gaps of what is required to operate the business, is not included in the deal, and the Buyer cannot stand up and operate by the Closing Date. TSAs are similar to standard customer agreements, such as a Master Services Agreement (MSA) with supporting scope appendices. To expedite the process, reach out to your network and find an individual who has experience drafting TSAs.

5. Re-Engage - Jointly confirm with your counterpart your understanding of the processes, people, and the supporting applications and “what’s in/what’s out” of the deal. Review draft transition service agreements and obtain alignment on the post-close operating environment.

6. Negotiate - Develop pricing and duration for the transition services. Typically, the Deal Team negotiates pricing and duration in context with the broader deal negotiation.

7. Launch - After scope, pricing and duration have been aligned, hold a kick-off meeting between the Buyer, Seller and Carve-out Business Unit team and begin detailed planning for the Closing Date and post-closing operations. The TSA agreement will not cover all details and the joint teams will need time to align on deliverables, formats, work-arounds, methods and schedules. Beyond the workshop approach and subsequent steps, this situation also pointed out some broader and more strategic M&A lessons learned that transcend a specific deal-type and can be useful for any acquirer and any deal, however they are especially important in what many consider the hardest of all deal types – the carve-out acquisition.

• Keep a Customer Perspective - During the transition service agreement process, there will be many situations in which the buyer and seller may not agree on the approach, costs or duration. When the situation arises, it is typically best to think about what is best from a customer perspective. Both the buyer and the seller have vested interests to make sure that the products and services being delivered from the divested business unit will remain at the highest quality throughout the deal process. Nobody wants a customer to have a negative experience as a result of the transaction.

• Speed is Important - TSAs are a critical part of the deal documents and the initial operations of the acquired business. No functional leader, Buyer or Seller, wants to be the roadblock to sign a deal because TSAs are not complete. As quickly as possible after gathering requirements, draft transition service agreements and begin the process to clarify scope, costs and duration. For example, if you hosted a joint requirements workshop on a Wednesday/Thursday, it should be your team objective to draft TSAs and review on the following Monday. It always takes longer than expected, and time should not be wasted.

• Educate on Deal Mechanics – Most deal teams and integration professionals are experienced in a stock/share purchase agreement, which is the standard deal structure to purchase a company. However, carve-out deals typically use an asset purchase deal structure and the deal mechanics have important differences. If your functional leads are not able to describe the differences between a “stock deal” and an “asset purchase deal,” it may be a good idea to schedule a tutorial with your Corporate Development team and explain the key differences in the deal mechanics.

• Build Relationships - No matter how thoroughly the teams may try to draft comprehensive TSA documents, experience tells us that you will never anticipate all issues that may arise during TSA operations. The best defense to mitigate unforeseen issues is to develop a trusted relationship with your TSA counterpart. Go meet your counterpart in person, take the team to dinner, and schedule regular checkpoints to confirm status, address issues and work solutions. The relationship will pay dividends.

In full transparency, from start-to-finish the entire effort described above took about four weeks. But given the incredible amount of planning, collaboration, trust and true insight about each counterpart organization that started at the TSA development workshop, if asked again at dinner what’s the fastest we can develop a TSA -- my answer will be clear. “Give us two days!”

###

Mark Juergens, Senior Partner at M&A Partners, has over 25 years' professional experience spanning corporate strategy, M&A and client services leadership in a telecom strategy consulting firm. He has led due diligence, pre- and post- acquisition integration planning and multi-country integrations for over 20 deals totaling value over $5 billion in value. Mark’s industry expertise includes: corporate development, telecommunications, strategy consulting and accounting/audit services.

Before joining M&A Partners, Mark was a VP/Director, both at Ericsson and Verisign and led corporate development and Integration teams to complete deals ranging from security services, software and mid-size technology infrastructure companies to large telecom service providers.

Mark has over 15 years of customer-facing roles in advisory services working for clients such as: AT&T, Sprint/Nextel, Cox, and P&G, Microsoft and Piper Jaffray. His career began as a CPA at Deloitte in Minneapolis, Minnesota, and his experience includes multiple expatriate assignments in Prague, Czech Republic, and Melbourne, Australia.

-------------------------------------------------------------------------------

Join our talented team of presenters for The Art of M&A® Integration Fundamentals, a virtual event via Zoom, Feb 13-15, 2024. Registration and more information here.