The challenge with any survey summary or set of general principles for success is moving from awareness and "aha" moments to application and action. Today, I’d like to shine the spotlight on specific, actionable strategies that every acquirer should do to minimize value erosion during M&A integration.

Value erosion is a defined term of art in the M&A integration world. It means something specific – not just a general notion of a vague, hypothetical condition. You can read more about the definition and typical occurrences of Value Erosion in a few prior blog posts, including The Riskiest Day and the subsequent three-part mini-series on Getting the Riskiest Days Right (Announcement Day, Day-1 and Operational Cut-over).

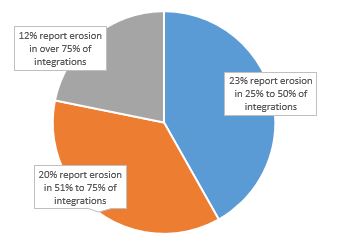

"55 percent of respondents ... indicated they experienced Value Erosion in more than one-fourth of all integrations."

If you had a chance to view or download our survey overview webinar you will also recall that Value Erosion is not just a theoretical risk. In fact, 55 percent of respondents to our State of M&A Integration Effectiveness™ Survey indicated they experienced Value Erosion in more than one-fourth of all integrations. As highlighted in the chart below, the detailed breakdown of specific responses is downright alarming and clearly points out that for most acquirers, this is still an area that needs work.

In what percentage of integrations do you experience Value Erosion, business disruption or unanticipated negative synergies due to integration actions taken or not taken?

In what percentage of integrations do you experience Value Erosion, business disruption or unanticipated negative synergies due to integration actions taken or not taken?

So let's get right down to business by drilling into the top ten best integration practices proven in our study to make the largest percentage increase in minimizing value erosion.. A summary of the regression analysis on this point is provided as this week’s downloadable resource, Essential Strategies for Minimizing Value Erosion.

The first essential strategy should, by now, be a given. "Develop a comprehensive integration strategy framework" was the number-one most impactful best practice on several of the key business outcome measures we tested, including minimizing value erosion. We’ve addressed our suggested version of this best practice, the Integration Strategy Framework (or "Game Day"), in a few prior blog posts including, Game Day Integration Strategy Summit.

Next, let me list a group of four of the top ten essential strategies for minimizing value erosion to reference at your convenience through other recent blog posts. These four include:

- "Effective staffing model for integration" (see Business Impact of Integration Project Staffing)

- "Effectiveness of overall integration process"

- "Focus on essential Integration Complete objectives"

- "Timely, efficient and well-coordinated integration process." (For the last three, please see Integration Practices That Drive Maximum Synergies.)

Now let's spend some time on the five remaining top ten strategies for minimizing value erosion. I think you can relate to, and maybe commiserate with, these findings and the extreme importance of getting these right in every integration.

"Each function/business unit has documented the specific knowledge content, project plans, tasks and tools needed to achieve consistent, repeatable success in their respective integration responsibilities"

We applaud the large number of acquirers that have worked hard to establish M&A playbooks and build their own knowledge content of what works and "lessons learned." Looking at the straight frequency response data, 48 percent of respondents said their functions were equipped with this level of readiness, while 47 percent still said they were not. As we have worked with many high deal-count acquirers to get functional M&A skills to the next level, we routinely see the need for these enhancements:

- Start with the enterprise level, end-to-end M&A lifecycle map, then have all functions align their specific inputs, involvement, requirements and deliverables to each phase of the M&A lifecycle including strategy, diligence, transaction, integration and long-term value capture;

- Redefine "playbook" to mean the entire series of artifacts, samples and skills needed throughout the entire lifecycle, not just the checklist for integration post-close stage; and,

- Watch the "weakest link phenomenon." Due to the high-level of cross-functional dependencies, each integration is only as effective as the weakest link. Ensure each function follows a standard approach and has at least a solid baseline competency. (Note: for more information on our view on playbooks, please reference Ten Principles for Integration Success.)

"Effective coordination and resolution of cross-functional integration issues and requirements"

The frequency data on this question is telling. An alarming 71 percent of respondents rate themselves very poor, poor or average on this important dimension. Before your next integration, consider the following:

- Review all functional/business-unit tools, plans and deliverables to verify adequate focus is provided to cross-functional requirements

- Conduct a joint integration team leader review session to identify and discuss anticipated cross-functional issues

- Consider software applications that enable you to identify cross-functional dependencies more easily, automate cross-functional tasks and workflow, and produce appropriate dashboards and reports to highlight the status of key cross-functional items. (For more information see Software Tools Drive Increased M&A Success and our software solutions.

"Retention & re-recruiting of key talent throughout the organization using a variety of tools and solutions to cost-effectively meet specific retention needs"

I have to acknowledge that we were surprised by the frequency response data on this question. A full 68 percent of respondents rated themselves as “very poor, poor or average” on this question. Most executives and M&A team members will quickly reference retention as a key success factor, but our survey findings indicate that most organizations still struggle to define and implement effective solutions. We’ve covered this topic extensively in our book, The Complete Guide to Mergers & Acquisitions, and in a prior blog post, Retain Key Talent, so we’ll limit suggestions on this point to these three essential recommendations:

- A compelling, ongoing and well-communicated message of strategic fit, value, respect and alignment

- A variety of financial retention strategies including base compensation, incentives, stay or performance bonuses, project team or integration objective bonuses, and the like

- Your ability to creatively and competently demonstrate that you are, in fact, the employer of choice. Of the three points listed here, in our opinion, this is where most organizations should immediately pull out the stops

"Effective transition / implementation of core business processes, systems and practices"

Once again, we have to shoot straight on this important measure of success. Of our respondents, 69 percent rate themselves as very poor, poor or average on this question. This is the tough stuff, and there are many reasons for the difficulty in getting this element of integration right. It may sound odd, but in our view, value erosion in this area is often not due merely to lack of adequate and detailed planning, training, testing/pilot efforts, etc. – although those are certainly essential for success. More often than not, when we see problems with conversion of core processes and systems, it can be attributed to one or more of the following:

- Failure to adhere to an aligned business-IT strategy that accomplishes key priorities in sequence from Day-1 requirements to quick wins and transitional arrangements, to operational integration, to long-term technology rationalization

- Failure to adequately manage the major “dissimilarities” in IT, operations or cultural and administrative practices. For example, think about widely dissimilar enterprise systems like Oracle E-Business vs. SAP; core enablers, such as Lotus Notes vs. Exchange/Outlook; and legacy/home-grown applications vs. third-party solutions

- Failure to fully understand the target company’s business model, unique value-creating capabilities, or processes which get destroyed under a “convert all” scenario (See What Really Happened to Daimler Chrysler)

"Timely, effective decisions by executives"

Unfortunately, the frequency response data is no better on this super-essential integration best practice, with a full 61 percent of respondents indicating that they are very poor, poor or average on this dimension. We’ll cover more on the essential role of effective leadership and decision making in a future post, but in terms of immediate triage, consider these possible approaches:

- Conduct a formal RACI analysis to confirm and communicate governance accountabilities, responsibilities, involvement, etc., for specific decisions, scope areas, and tasks between corporate, division, executive sponsor, integration leader, newly acquired target executives, etc.;

- Commit to executive team and integration management office (IMO) service-level agreements (SLA’s) to codify expectations for prompt and effective review, input and decision cycles;

- Clarify your escalation process to ensure adequate steering team or executive committee involvement on major issues or tie-break considerations.