Practical Strategies for Managing TSAs with Confidence and Clarity

By M&A Leadership Council

Transition Services Agreements (TSAs) are critical tools during divestitures. They serve as a bridge, ensuring business continuity while the buyer establishes their own operational systems.

However, navigating TSAs can be challenging, and without a clear strategy, they can become a source of delays and conflicts.

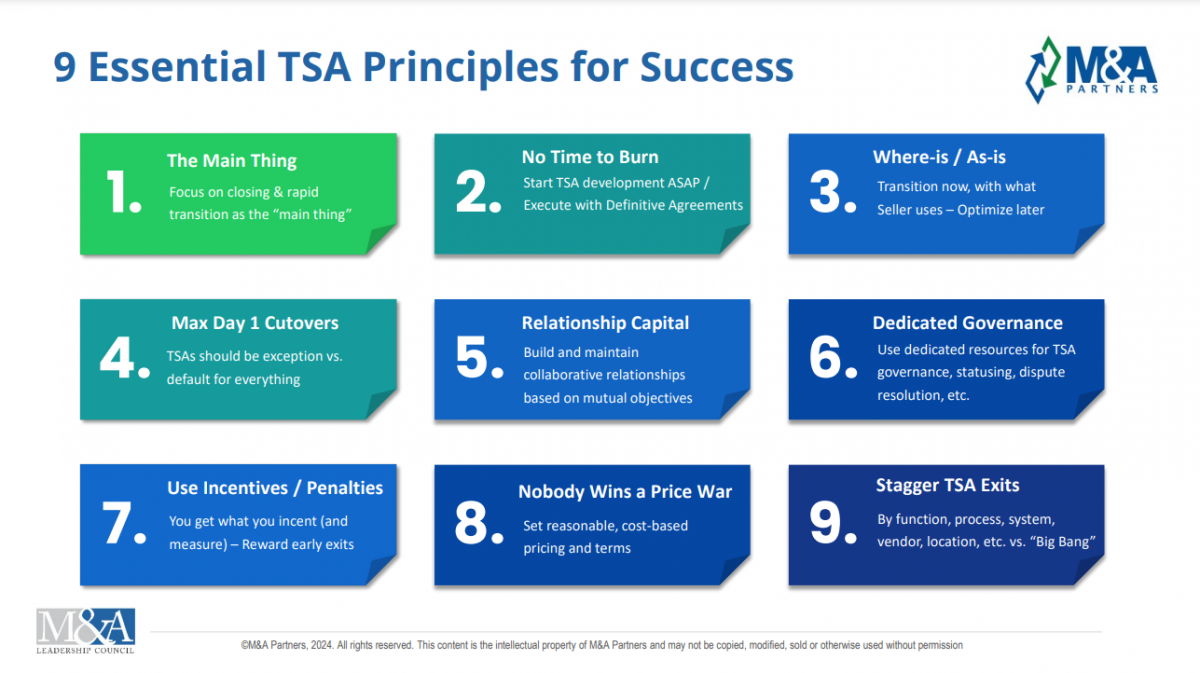

This blog explores nine essential principles to guide you through a successful TSA, helping you avoid common pitfalls and achieve a smooth transition.

1. The Main Thing: Focus on Closing & Rapid Transition as the “Main Thing”

In divestitures, it’s easy to get sidetracked by operational details, but the primary goal should always be to close the deal and transition swiftly. Delays in closing can create uncertainty, strain resources, and lead to integration fatigue. Prioritizing a quick and efficient transition helps maintain momentum and reduces the risk of business disruption.

Insight: Keep your teams aligned on the end goal—finalizing the deal and moving towards full independence. Avoid getting bogged down in over-analysis or unnecessary complexities that could derail the process.

Example: Consider a scenario where a company spent months fine-tuning operational details, only to see the deal falter due to market changes. Had they focused on closing and rapid transition, they might have avoided the fallout.

2. No Time to Burn: Start TSA Development ASAP / Execute with Definitive Agreements

The sooner TSA development begins, the better. Ideally, TSAs should be in place when the definitive agreements are signed, ensuring all parties are clear on the terms and expectations from the outset. Delaying TSA discussions can lead to rushed, incomplete agreements that may cause friction later.

Tip: Develop a parallel timeline for TSA creation that aligns with the negotiation of definitive agreements. Involve key stakeholders early to ensure the TSA reflects the operational realities of both parties.

Advice: Accept the seller’s existing setup for Day 1, with a plan to optimize once the transition is complete. This pragmatic approach reduces complexity and helps maintain business continuity.

Example: A buyer who insisted on immediate system upgrades encountered significant delays and cost overruns. By following the “where-is/as-is” principle, they could have ensured a smoother, more efficient transition.

4. Max Day 1 Cutovers: TSAs Should Be the Exception vs. Default for Everything

While TSAs are useful, they shouldn’t become a crutch. Aim for full operational cutovers wherever feasible on Day 1. TSAs should only be used for areas where immediate transition is not practical, reducing reliance on the seller and speeding up full integration.

Insight: Evaluate which functions can be fully transferred on Day 1 and prioritize those cutovers. Reserve TSAs for truly complex or high-risk areas where immediate transition would be disruptive.

The success of a TSA often hinges on the quality of the relationship between the buyer and seller. Building collaborative relationships grounded in mutual objectives can prevent misunderstandings and facilitate smoother interactions. Trust and open communication are key to resolving issues quickly and keeping the transition on track.

Tip: Invest time in understanding the seller’s perspective and aligning on shared goals. Regular communication and problem-solving sessions can help maintain a positive, productive relationship.

Example: A buyer who took the time to build rapport with the seller’s team found that disputes were resolved more amicably and efficiently, leading to a smoother overall transition.

TSAs require focused management to be successful. Assign dedicated resources to oversee TSA governance, track progress, and resolve disputes. This ensures that the TSA doesn’t become a secondary concern, but rather a well-managed process with clear accountability.

Advice: Establish a TSA governance team with clearly defined roles and responsibilities. Regular status updates and proactive issue resolution should be integral to their mandate.

Example: A company that appointed a dedicated TSA manager was able to quickly address issues as they arose, avoiding escalation and keeping the transition on schedule.

7. Use Incentives / Penalties: You Get What You Incent (and Measure) – Reward Early Exits

Incentives and penalties are powerful tools for driving behavior and ensuring compliance with TSA terms. By rewarding early exits and holding parties accountable for delays, you can encourage a faster transition and minimize disruptions.

Tip: Structure incentives and penalties around key milestones and deadlines. Ensure that they are meaningful enough to motivate both sides to meet or exceed expectations.

Example: A seller who was incentivized to exit the TSA early delivered ahead of schedule, saving the buyer significant costs. Clear incentives aligned with both parties’ goals proved highly effective.

8. Nobody Wins a Price War: Set Reasonable, Cost-Based Pricing and Terms

Setting reasonable, cost-based pricing from the start avoids unnecessary conflicts and ensures a fair arrangement for both parties. Price wars can damage relationships and lead to drawn-out negotiations that hinder progress.

Insight: Base TSA pricing on actual costs and market standards, ensuring transparency and fairness. Both parties should feel confident that the terms are equitable and conducive to a successful transition.

Example: A company that insisted on unrealistic pricing terms faced prolonged disputes that strained the relationship and delayed the transition. Fair, cost-based pricing would have facilitated smoother negotiations.

9. Stagger TSA Exits: By Function, Process, System, Vendor, Location, etc. vs. “Big Bang”

Rather than aiming for a “Big Bang” exit, where all services transition at once, consider a staggered approach. Exiting TSAs by function, process, or location allows for a more controlled, manageable transition and reduces the risk of disruption.

Advice: Develop a detailed exit plan that prioritizes critical functions first, with clear timelines for each phase. This approach enables smoother handoffs and minimizes the potential for operational hiccups.

Example: A company that opted for a staggered TSA exit saw fewer disruptions and was able to maintain business continuity throughout the transition. The phased approach allowed for troubleshooting and adjustments along the way.

Following these nine principles can help ensure a successful TSA, enabling a smooth transition and setting the stage for long-term success.

By focusing on rapid closure, starting early, maintaining collaborative relationships, and managing the TSA with dedicated resources, you can navigate the complexities of divestitures with confidence.

Remember, the goal is not just to transition, but to do so in a way that positions both the buyer and seller for continued success.

-----------------------------------------

Take the Topic to Your Team: DOWNLOAD Our GUIDE and get a conversation going.