Paranoia: Running Scared Can be an M&A Best Practice

By Jack Prouty, Past President, M&A Leadership Council

Successful mergers and acquisitions hinge on creating value and mitigating risk.

Working in M&A over the last 30 years has taught me the high value of being paranoid.

Many challenges will crop up throughout any deal: from diligence, to integration pre-close planning, and post-close transition management.

M&A deals are challenging and complex: it is not business as usual. You need to expect and be prepared to deal with issues throughout the deal. Anyone expecting everything to operate smoothly and just as planned will have a disappointing and short career.

A short, but true story illustrates my point: Early in my career, a client asked me, “Have you ever seen someone who kept his head while everyone else was losing theirs, and then realized that he was the only one who did not understand the problem?”

Successful M&A project managers stay ahead of the game by taking on a risk management mindset. Andy Grove said it best, “Success breeds complacency. Complacency breeds failure. Only the paranoid survive.” And when it comes to M&A there could be no truer statement! I get paranoid when things seem to be going well because I know it is only a matter of time before we will get hit with a major challenge to the successful management of the transaction. Only a fool assumes a perfect acquisition. There will always be broken glass.

My approach is this: prevent being surprised by sudden emergence of issues by doing a better job of effective planning and preparation, as well as ongoing monitoring of activities and the tracking of potential issues and risks. It will not eliminate the “gotchas,” but should they arise, you will be ready to quickly react to them to mitigate their impact.

Even at my age and experience I still approach every M&A with a level of paranoia.

But here are some things I find help to avoid unforeseen issues:

- Build a database of all the things that could possibly go wrong in the M&A, based on past deals you have done and on the experiences of others. Then refer to this checklist through the M&A process.

Many years ago, as the SVP/CFO of a Midwest retailer, we took on our first acquisition – a company of similar size. I was responsible for leading the effort, as most of the back-office operations reported to me. So I called up a number of CFOs from major retailers and quizzed them on both the smartest and the dumbest things they did. Then I leveraged their learnings in how we approached our integration efforts. I continued to build this database as I transitioned back to consulting and built business integration competencies across two firms, while working on over 100 projects ($5 million to $40 billion transactions).

- Keep it simple.

This sounds like motherhood and apple pie, but let me explain. The more complicated your approach is, the greater the probability of risks and problems. Follow the advice we preach in our training courses: Stabilize then Integrate then Optimize; focus on the 3 S’s (Speed, Stability and Synergies), keeping these in balance. There are always at least 2 ways to address an issue, pick the easiest one.

Again pulling from lessons learned and executed when I was in retail: some companies tried to develop a fancy method for customers of both the acquired company and their company to continue to use their existing store credit cards. It typically did not work and took too long to develop a technical solution. So we issued the “new” customers our store credit card before the conversion. They could continue using the acquired store’s credit card until the conversion and then use ours after. This was just one of many simple solutions we made. Because our CEO often said, “Retail is a simple business made complex by simple people,” we elected to keep our approach toward integration simple and easy.

- “Plan the plan” before “executing the plan.”

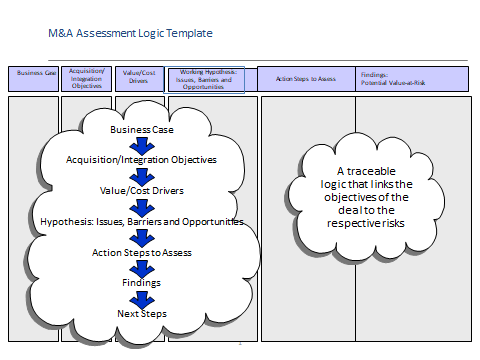

Spend time before launching the diligence effort and then again before launching the integration by going through an M&A assessment logic with the team to ensure that critical areas will be addressed and to generate hypotheses on potential issues and risks. Here is an example:

- Throughout the process, identify and review potential contingency plans. Murphy’s law is alive and well: if something can go wrong, it will.

Here are examples of representative questions to ask and then think through how to address:- If we are not able to retain a certain person (or worse yet, they already resigned), what is our fallback plan?

- If we are not ready to get off the TSA by the end date, what is our alternative?

- If we are only at 75% of the synergies we committed to the Board, what actions can we take to create more synergies?

- How do we respond to being surprised with another $5 million in necessary IT investment?

We need to anticipate issues like the above through analysis, pre-planning and constantly thinking through what could go wrong, how to mitigate the impact or if there are any work-arounds. I find that by putting in early warning systems and tracking key metrics, we can uncover some issues before they surprise us. For example, employee turnover is a lagging indicator: it is measured after the damage is done. But employee satisfaction reveals potential problems that would increase employee turnover, with (hopefully) enough lead time to effectively address them.

After having seen a number of M&A deals go awry, every time I lead an M&A initiative, I spend each evening and sometimes late into the night thinking about potential issues and how we need to prepare for them. I am quite serious when I say, “Paranoia is a best practice in M&A.” If you are not paranoid, then you have not been involved in M&A planning and managing!

---------------------------------------------------------------------------------------------------------------------

Learn more about risk mitigation and effective M&A planning at our next two upcoming events:

The Art of M&A® for Due Diligence Leaders / In-Person - Boston, Sept 12-14, 2023

The Art of M&A® for Integration Leaders / In-Person - San Diego, Oct 11-13, 2023

See our Training Calendar for all upcoming courses in 2023.