What makes a truly effective M&A program manager? We get asked that question a lot by executives interested in hiring the best-of-the best for this important role in M&A. Frankly, we are delighted by that question because it gets at the core of a long-overlooked, often disparaged, but mission critical capability that any serious acquirer must consistently “hit out of the park” on every deal.

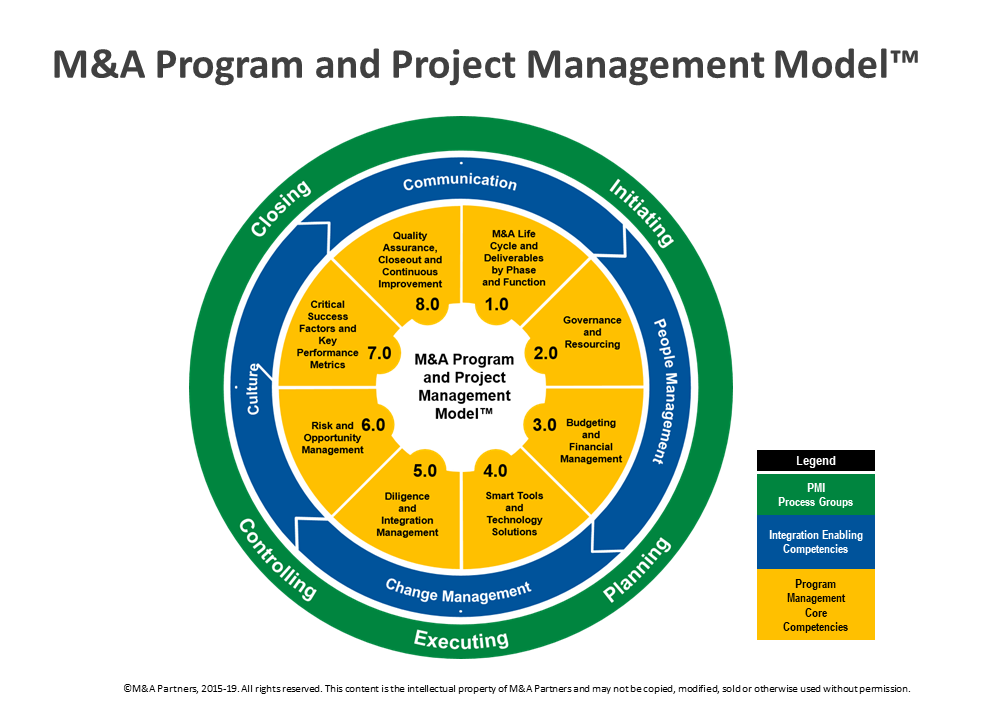

Two quick caveats before diving into this key question. First, setting up and running a world-class diligence management office (DMO) or integration management office (IMO) is tough. We often say that M&A success requires superb top-down, strategy-based leadership supported by superb bottom-up program management and execution. It’s not only true, but it is surprising how frequently even skilled acquirers are missing components of one or both of these critical success requirements. Second, there are many important skills, process requirements and capabilities that go into “successful M&A program management.” As illustrated by the chart below, truly effective M&A program managers are a special breed.

One highly experienced colleague lamented to me one time that trying to find the right, highly experienced M&A program manager was like trying to find a Unicorn! I agree – just look at the range of experience, skills and process maturity that has to be fully operational for M&A program managers to be fully successful. That’s one reason we highly recommend every acquirer to attend the M&A Leadership Council’s workshop, The Art of M&A Program Management (May 7-8, Scottsdale, AZ). This workshop is a practical, interactive session that is designed to pick up where basic program management and PMP training leaves off. Specifically focused on the role of the M&A program manager across each phase of the M&A lifecycle, it is chock full of best practices, peer networking and lessons learned from people and organizations that know how to get it right.

Now, about the five essential M&A program management disciplines – here they are in reverse order. Arguably, #4 and #5 are the most important disciplines, bar none. In many cases that is absolutely true. But without the basic foundational elements described in disciplines #1–3, we can’t think of a single case where M&A program managers were able to effectively achieve the later, higher-level impacts described by disciplines #4–5.

5. Focus leaders and workstream leads on key value-drivers directly aligned to the core deal thesis.

Wait a second, you are saying, “isn’t that a key leadership job?” Yes, it is, and it should be. But best practice acquirers build a discipline of translating the key value-drivers down to the level of each workstream, then create specific, high-priority initiatives to tackle those essential outcomes immediately. In our view, M&A program managers have to be in the thick of this value-creation process with at least three roles. First, based on factors such as the deal thesis, growth/synergy assumptions and board approval deck, high-level strategy or outcome statements often have to be purposefully linked to specific initiatives which begin immediately upon closing and can be staffed, planned, resourced and tracked with objective metrics. Value-drivers are the compass for each integration, not the airspeed indicator. No amount of incredible status tracking of “milestone burndown” will tell your executive team and board if integration is heading in the right direction. Only value-drivers can do that. Here’s just one client example of a simple way to do that.

Key Objective: “Leverage TargetCo’s superior Network Solutions expertise with BuyerCo’s scale and client base to grow market share by “X” in year 1, post-close.

Key Priority Initiatives for this strategic outcome included:

- Provide TargetCo “boot camp” training for BuyerCo’s BDMs, SSEs and Solution Center resources

- Provide access to networking experts for the existing BuyerCo Solution Center to support the review of deals and to assess opportunities (e.g., can we add 3 or 4 networking experts to the Solution Center?)

- Package TCM offering for Enterprise Sales and RNOC offering for SMB Sales

Pardon the genericized company and industry specifics illustrated here – but you get the point. Now each priority initiative can be assigned to a key leader for accountability purposes; and then planned, resourced and tracked to ensure near-term completion. Without this level of shared responsibility between key leaders and M&A program managers, this organization would be “going nowhere, but making great time” with integration.

4. Decision Support.

Truly effective M&A program managers don’t just wait around for senior executives to make key due diligence or integration decisions – they actively support the executive committee, business lead and integration lead by helping prepare for decisions, setting specific decision calendar dates and communicating what has been decided. First, a bit of context. We believe successful integrations should be managed by a robust governance and accountability model that results in approximately 75% of decisions being made closest to the “action” and subject matter experts as possible. But what about those “biggies” that can freeze an organization or key process? These must be actively managed, and that usually means the M&A program manager (or IMO) is in the single best position to do that. Consider to what extent your current approach includes these essential practices:

- Decision Analysis Input Process – When a major “decision-needed” is identified by a workstream, what process does your IMO use to capture all meaningful decision inputs? Depending on the specifics of each decision-needed, we’ve used either a “light” or “full” data input template to capture key insights, alternatives, risks, costs, synergy impact, etc., to support the executive committee with what they need for effective decision making.

- Decision Acceleration Work-outs – Some time ago, a key client called just days after the engagement began. “Could we get your input on another integration matter?” they asked. It seems that on prior major integration, the organization was hopelessly wrapped around the axle in making a major platform decision. It was understandable – big stakes, significant cost and risk and, at least in this case, way too many people involved in decision process. Our recommendation? An IMO-led Decision Acceleration Work-out session. Carefully planned and choreographed to ensure appropriate research, analysis and decision alternatives were produced, vetted and provided to a select and uniquely empowered “decision team,” we co-facilitated a one-day session in active collaboration with the client. The ground rules? A best-case decision hypothesis will be made at the end of this session, then socialized with other key leaders, before being formalized and announced within one week’s time.

- Integration Steering Committee Decision Calendar – For most ongoing decisions, your designated “SteerCo” will be more than able to decide effectively. Oftentimes, we find the missing element is not the ability to decide, but the awareness of decisions and the calendaring of specific decision dates to enable the SteerCo to be fully prepared for effective decision-making. For example, in a recent major integration, our team supported each workstream in identifying decisions needed by month (in the first calendar quarter post-close); then by each calendar quarter during the next year. In addition to decisions related to the workstream, we tapped into major business unit and strategic change initiatives such as the value drivers; organization and staffing; branding; productivity improvements; and overall go-to-market strategy, to name a few. Each initiative area listed key decisions needed by time frame. The IMO iterated a draft decision calendar based on magnitude, priority, cross-functional dependencies and risk/cost/impact, then reviewed the draft with the SteerCo. Further refinements and resequencing tightened the IMO’s initial analysis, until the SteerCo committed to making those specific decisions by the scheduled dates with the IMO’s continued support with data, analysis and alternatives presented at each SteerCo meeting.

3. Statusing.

Now we are into the “bread and butter” of effective M&A program management. Simply put, without an effective and consistent method to objectively observe, assess and report on how things are going across the integration, you can’t integrate. Fortunately, most organizations have a process for determining status at recurring intervals. In its most basic representation, a standardized template should be collected from each workstream leader on a weekly or bi-weekly basis, their progress for the prior period; status of key milestones in process; next milestones or tasks to complete; risks, issues or decisions-needed; dependencies they are waiting for; performance against KPIs, and the like. In our view, that is just the starting point. The M&A program manager (or IMO) then must analyze, summarize and prepare appropriate reports for the SteerCo. More importantly, though often completely overlooked, is the M&A program manager’s role in directly observing, participating in and personally validating what is going on in each specific workstream. In practice, far more effective “statusing” is experienced rather than reported. In sum, as the M&A program manager – you have to be in the mix with every workstream, every week. That takes time, resourcing and expertise; and it illustrates why this is a team sport and why more and more organizations are interested in using purpose-built software solutions to help automate and accelerate the reporting and statusing elements of program management.

2. Risks, Action Items, Issues and Decisions Needed (“RAID” Log).

This is another basic, but fundamental element of effective M&A program management, and one we still see being undermanaged even in sophisticated organizations. In our view, the best practice consists of the M&A program manager (or IMO) owning the RAID log and process, which is fed weekly or bi-weekly by the statusing and cadence process. Frankly, the M&A program manager (or IMO) is in the singular best position to help identify, manage and report these critical data points. But therein lies two common problems. First, the data is not sufficiently analyzed, parsed and reported to enable the degree of prioritization and action planning needed. Sometimes this is due to the software solution itself. As practitioners, you know that a risk is not the same as an issue, and an action item is not the same as a key decision needed. Lumping them together for expedience sake is usually a mistake. Second, the principal role of the M&A program manager is to tackle and resolve these RAID issues. Not that you are necessarily the subject matter expert to individually decide each issue, but as one client put it, “the role of the IMO is to identify needs and issues, then go get the right resources together to proactively solve those issues.”

1. Cadence.

For M&A program managers, cadence is like the headwaters of the Nile River. It’s where it all begins. As such, it is so fundamentally important, it is impossible to overstate the importance of establishing the cadence early and managing it consistently well over the entire lifecycle of the deal. We had a client many years ago whose M&A process had NEVER established the discipline of cadence. Whenever an issue popped up, the M&A program manager would rush to the scene. Emails would be sent, a succession of meetings and Webex sessions would be conducted, usually resulting in a bevy of closed-door meetings with individual executives. Eventually, a decision would be socialized and gradually communicated to those needing to know. Maybe that would be OK in terms of running a business in normal times, but with each integration, the M&A program manager, workstream leaders and key executives were constantly fighting fire upon fire and literally spending 12 hours a day on conference calls. We affectionately nicknamed that program manager Popcorn Joe after the way he jumped to the sound of each new crisis breaking loose. Contrast that with the flywheel of cadence. This is the routine weekly or bi-weekly process that the M&A program manager establishes to drive the organization forward with a fast, efficient status update; analysis and prioritization of all active RAID issues; and real-time coaching and instructions for the next week.

How does your M&A program management approach stack up to these five disciplines? Please email us or comment in social media about your viewpoints, insights and suggestions.

Don't miss the opportunity learn more from Mark and other M&A Partners this October as they present at the M&A Leadership Council's The Art of M&A Program Management. They are eager to share their real-world experience and valuable solutions with you during this 3-day training in San Diego, CA.