Global M&A Roundup for Q1

Submitted by Mergermarket/Acuris, a partner of the M&A Leadership Council

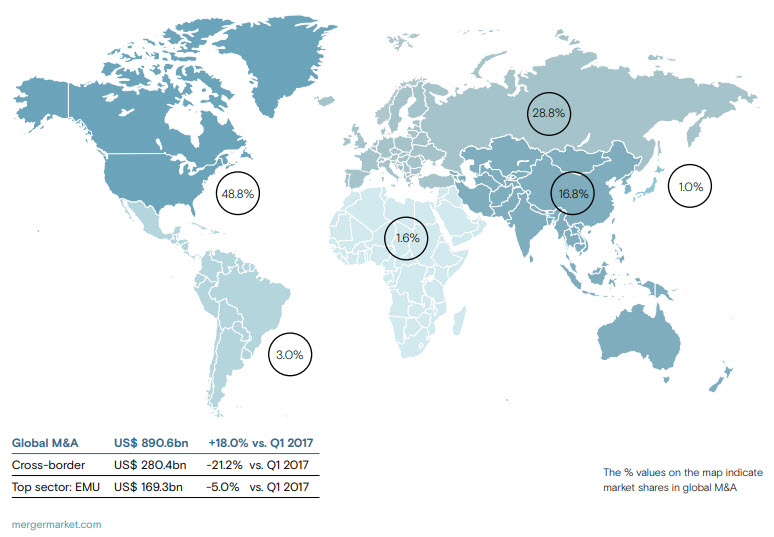

Mergermarket, an Acuris company, has released its Global M&A roundup for the first quarter (Q1) of 2018, including its league tables of financial advisors, and it’s very promising! The extraordinary surge in dealmaking seen at the end of 2017 has carried through into 2018 as global M&A hit its highest Q1 value on Mergermarket record (since 2001) as pressure from shareholders and the search for innovation continue to drive corporates towards M&A.

Take a look at the report HERE and don’t forget to review the charts breaking down the activity by sector, value, year-to-year analysis, etc.

A couple key findings include:

- In the first quarter, US$ 890.7bn was recorded across 3,774 deals, up 18% on Q1 2017’s value of US$ 754.7bn (4,672 deals). So far this year there have been 14 deals breaching the US$ 10bn mark, including the US$ 67.9bn deal between Cigna and Express Scripts. While big tech companies look to diversify their offering, often through M&A, more traditional firms have had to react to newer, more innovative firms, with many looking towards defensive consolidation. Amazon’s move into pharmaceuticals appears to have been a catalyst for dealmaking in healthcare-related areas with the CVS/Aetna deal announced in December and the Cigna/Express Scripts transaction this quarter

- The US has seen a sizeable increase in M&A during the first three months of the year with six of the largest 10 global deals targeting the country, and accounted for a 44.2% share of global activity by value

- Though the first quarter of 2018 is not likely to go down in history for shattering US M&A records, it could become known as one of the more interesting starts to a year. Among other happenings: the White House introduced steel and aluminum tariffs, sparking concerns over a trade war and spooking dealmakers; opening arguments were given in the antitrust trial between AT&T/Time Warner and the Justice Department; and President Trump blocked Broadcom’s takeover bid for Qualcomm. Finally, Comcast also entered the Media fray by exploring an offer to buy Sky in a competing bid with Disney, who is itself in the process of taking over most of Twenty-First Century Fox. The latter already owns 39.1% of Sky, and its acquisition of the remaining 60.9% is currently under regulatory review. One could not be blamed for believing that anything seems possible at this point. And, though US M&A fell by 305 deals to 1,148 compared to 1,453 in Q1 2017, value rose by 26.1% to US$ 393.9bn from the US$ 312.4bn recorded during the same period last year