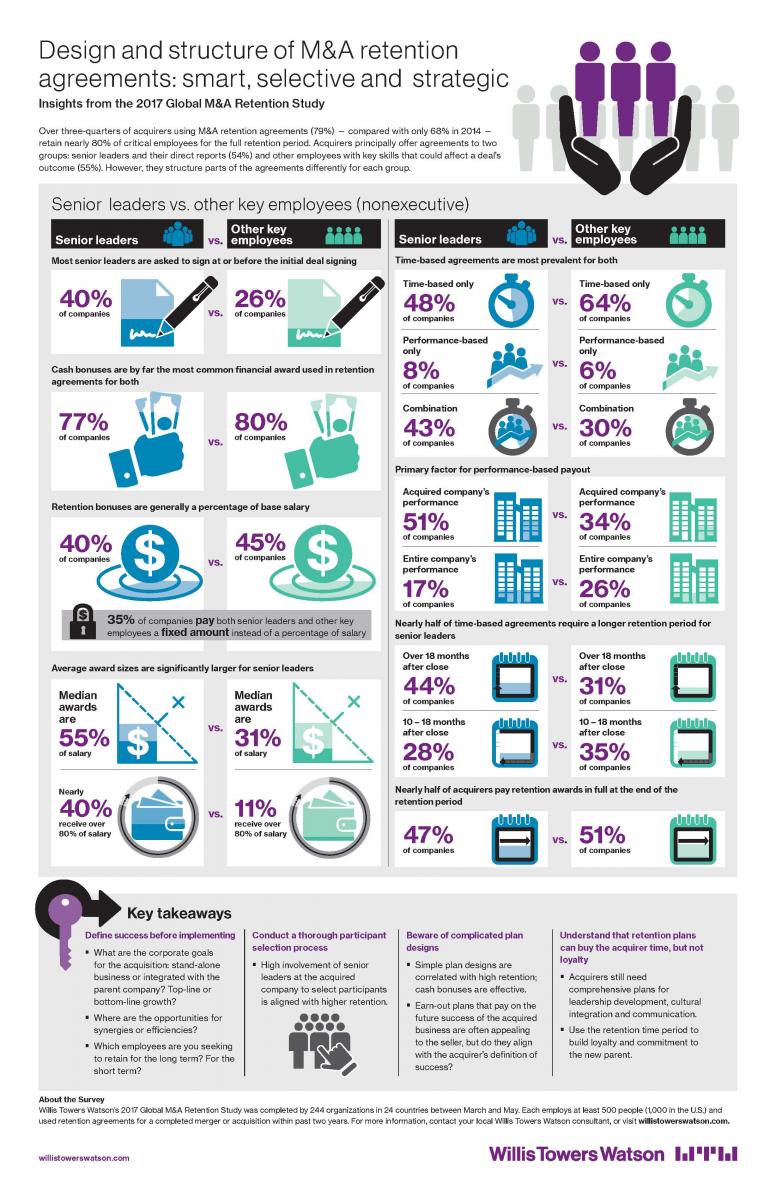

Willis Towers Watson has recently published its 2017 Global M&A Retention Study. The findings? Over three-quarters of acquirers using M&A retention agreements (79%)--compared with only 68% in 2014--retain nearly 80% of critical employees for the full retention period. Acquirers principally offer agreements to two groups: senior leaders and their direct reports (54%) and other employees with key skills that could affect a deal's outcome (55%). However, they structure the agreement differently for each group.

Key takeaways include the following:

- Define success before implementing.

- What are the corporate goals for the acquisition: standalone business or integrated with the parent company? Top-line or bottom-line growth?

- Where are the opportunities for synergies or efficiencies?

- Which employees are you seeking to retain for the long term? For the short term?

- Conduct a thorough participant selection process.

- High involvement of senior leaders at the acquired company to select participants is aligned with higher retention.

- Beware of complicated plan designs.

- Simple plan designs are correlated with high retention; cash bonuses are effective.

- Earn-out plans that pay on the future success of the acquired business are often appealing to the seller, but do they align with the acquirer's definition of success?

- Understand that retention plans can buy the acquirer time, but not loyalty.

- Acquirers still need comprehensive plans for leadership development, cultural integration and communication.

- Use the retention time period to build loyalty and commitment to the new parent.

The survey was completed by 244 organizations in 24 countries between March and May 2017. Each employs at least 500 people (1,000 in the US) and used retention agreements for a completed merger or acquisition within the past two years.