Regulations and uncertainty about reimbursement are among key risks.

Regulations and uncertainty about reimbursement are among key risks.

By Kevin Olvera and Shaun Buckley, BDO

Merger and acquisition (M&A) activity in 2017 was at a high level with:

- An enormous amount of capital available

- Low borrowing costs

- A strong equities market and

- A low rate of organic growth in many sectors of the economy

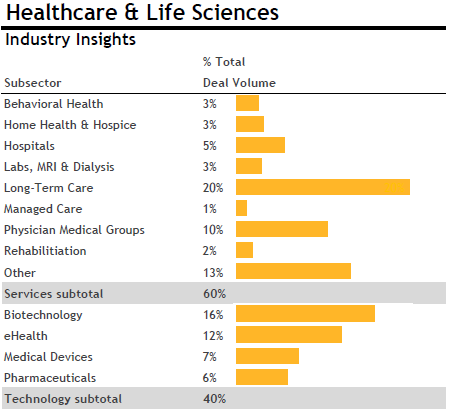

One industry sector that continues to be very active is healthcare services. This sector covers a broad array of services such as acute care, chronic care, and technology. There is a higher than average level of M&A activity in this area even though transaction multiples tend to be higher than in many other sectors.

M&A activity in the healthcare and life sciences sectors has been driven predominantly by increased regulation in the marketplace, and consolidation of a fragmented marketplace to create economies of scale as larger networks look to save on the cost of compliance. In addition, long-term care M&A activity remains hig as interest rates continue to be relatively low. Healthcare technology activity continues to be strong as investors look to capitalize on bridging the gap between higher value care at a lower cost. Read more.