The Benefits of Planning for and Engaging in M&A Discussions

By Mike Lord, Senior Consultant for Willis Towers Watson, an M&A Leadership Council Partner

You’ve spent years building your relationship with your scheme sponsor, developing a collaborative and integrated approach to funding and investment – then bang, out of the blue, a third party makes a bid for the sponsor and suddenly all bets are off.

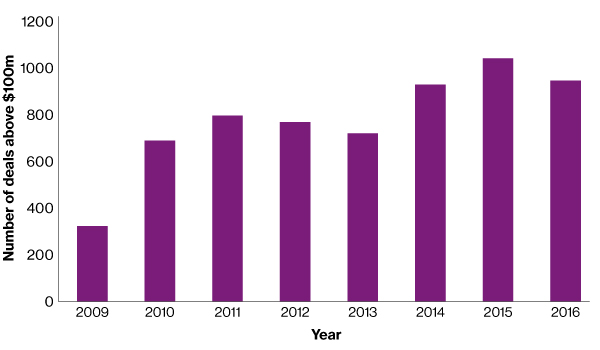

As shown in Figure 1, our research shows that despite a small drop off in 2016, deal volumes remain high, with 946 completed globally in 2016. Moreover, those completing transactions in 2016 outperformed their peers, continuing a long-running trend.

As shown in Figure 1, our research shows that despite a small drop off in 2016, deal volumes remain high, with 946 completed globally in 2016. Moreover, those completing transactions in 2016 outperformed their peers, continuing a long-running trend.

Without doubt though, the goal of creating value has become harder in a climate of low economic growth, increasing complexity and growing political risks. This brings greater focus on the key ingredients to successful M&A: identifying the right business, paying the right price, achieving synergies and successful integration.

So why should trustees be interested in this – and what role can they play to help rather than hinder the M&A process?