The mechanism creates a "win-win" situation.

By Greg Stowe, Director of Valuation & Business Analytics for BDO, a partner of the M&A Leadership Council

Transaction stakeholders continually are seeking innovative ways to translate deal value into a "win-win" situation for both the buyer and the seller. Among the mechanisms considered in structuring a deal has been the use of an earn-out in establishing deal value. This mechanism has gained significant traction over the past several years, particularly in middle market transactions.

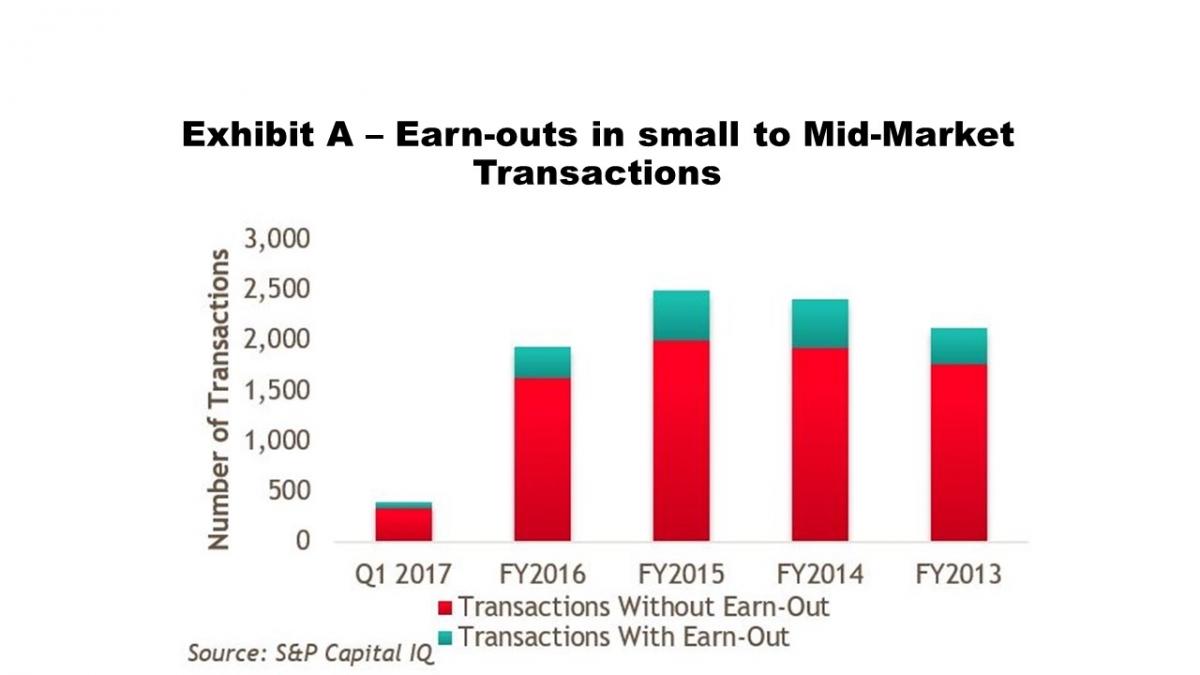

Please refer to Exhibit A at right for a graph of small to mid-market M&A deals between FY 2013 to Q1 2017. The graph indicates 15.8 to 20 percent of total deal flow was comprised of some form of an earn-out in deal value.

A judge aptly described the nature of an earn-out in the court case Airborne Health, Inc. v. Squid Soap, LP (Del. Ch. 2009) as follows: “What an earn-out… typically reflects is disagreement over the value of the business that is bridged when the seller trades the certainty of less cash at closing for the prospect of more cash over time.”