Quality Shines Through as M&A Deal Volumes Fall Globally

Provided by Willis Towers Watson, a Partner of M&A Leadership Council

The global M&A market continues to be a strategic driver of corporate growth, as executives seek to create greater value for their organisations in challenging economic times. This document summarises the year in review for the performance of transactions in 2016, along with our predictions for future M&A trends.

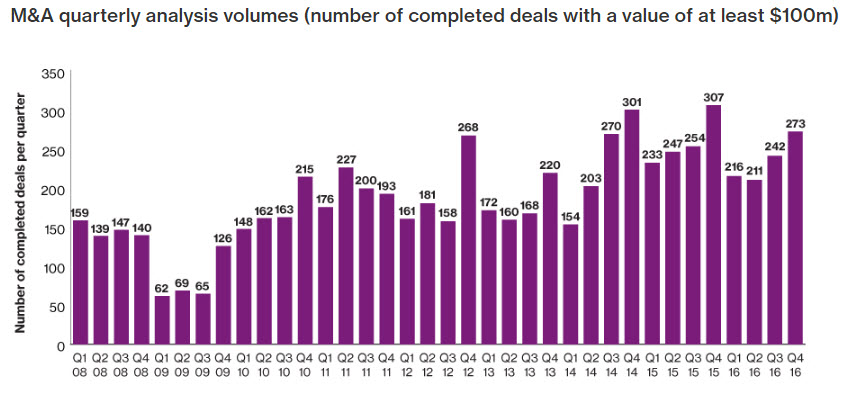

Willis Towers Watson’s Q4 2016 Quarterly Deal Performance Monitor (QDPM), launched in 2008, revealed a significant slowing of deal volumes in the fourth quarter of last year. On a positive note, transactions that did close in the same period of time outperformed the index1 by 0.6 percentage points (pp); continuing a trend from the past 36 quarters, where acquirers have outperformed, illustrating that growth by M&A does help deal makers achieve greater shareholder value.

The long-standing research – run in partnership with Cass Business School – showed deal volumes reduced from 307 in Q4 2015, to 273 in Q4 2016. The fourth quarter rally resulted in a strong ending for 2016 with 72 deals completing in the final weeks of the year.

Download the complete analysis here.