As Trump is Sworn in as President the Picture Will Become Clearer

Provided by Mergermarket, a Partner of M&A Leadership Council

For all the protectionist rhetoric that contributed to Donald Trump's stunning victory, dealmakers this week voiced hopes that, now that he is President-elect, the real estate mogul’s love of a deal would translate into a pro-business stance that would bode well for M&A activity.

Oil and gas and pharmaceutical stocks - among others - have rallied since Wednesday, as investors identify the likely winners and losers under a Trump presidency. After two years in the doldrums, the US oil and gas industry in particular is seen as a big winner, with expectations that Trump will boost domestic production and lead to a friendlier environment for building pipeline projects and deal activity.

Healthcare M&A could also be boosted by Trump’s tax amnesty for companies repatriating overseas cash hoards and incentives for creating US jobs, which may lead more drug companies to buy manufacturing assets in the US.

As for ongoing deals, the big question is how much of Trump’s campaign rhetoric was merely bluster and how much will translate into actual policy. As a candidate, he promised to block AT&T’s [NYSE:T] proposed acquisition of Time Warner [NYSE:TWXT]. Yet as president some experts believe he could shed the populist stance in favor of a more classic Republican laissez-faire approach to antitrust enforcement.

More uncertainty hangs over foreign investment despite Bayer's [ETR:BAYN] statement to this news service this week that its acquisition of Monsanto [NYSE:MON], the largest inbound deal from Europe this year, will not be impeded by the result of the election. Farmers are concerned about the deal, amid the wave of huge mergers affecting their industry.

Inbound M&A from China has been the big story this year but could be jeopardized by Trump’s expected more aggressive position towards China than his predecessor. Chinese bids for US assets year-to-date are at a record of high of USD 51.1bn across 65 deals, a 462.7% increase compared to the same period last year and 368.2% higher than the previous record from 2013.

Chinese investors say they will continue to hunt for US assets, but will tread more cautiously as they look for signs of a more hostile environment for buyers from China. Many China-US deals are currently awaiting US approval, so these processes could provide clues for what lies ahead.

As for outbound activity, US M&A into Europe has also surged this year, with 584 deals worth USD 152.2bn a 6% increase over last year. US outbound deals targeting Europe have hit a Mergermarket record average deal value at USD 677.8m.

Uncertainty now lies ahead. Trump’s policies may encourage US companies to buy at home, while his outspoken views on international trade deals could mean the Transatlantic Trade and Investment Partnership (TTIP) is dead in the water. On Thursday European Commission President Jean-Claude Juncker called for more clarity from Trump on his trade policy, among other areas.

Overall, the picture will become clearer once we know which Donald Trump will be sworn in as America’s 45th president on 20 January.

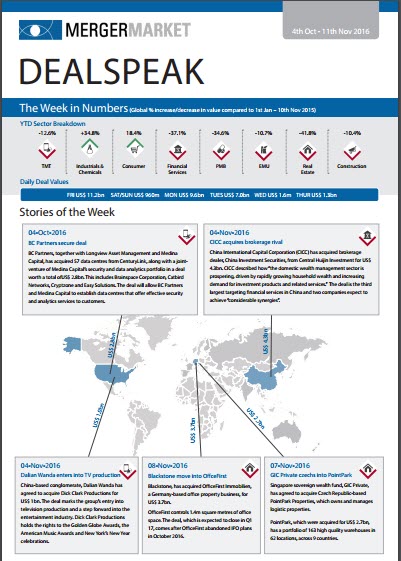

Dealspeak is a weekly snapshot of the latest trends driving global M&A. To view the newsletter click here.