by Mark Herndon, President, M&A Partners

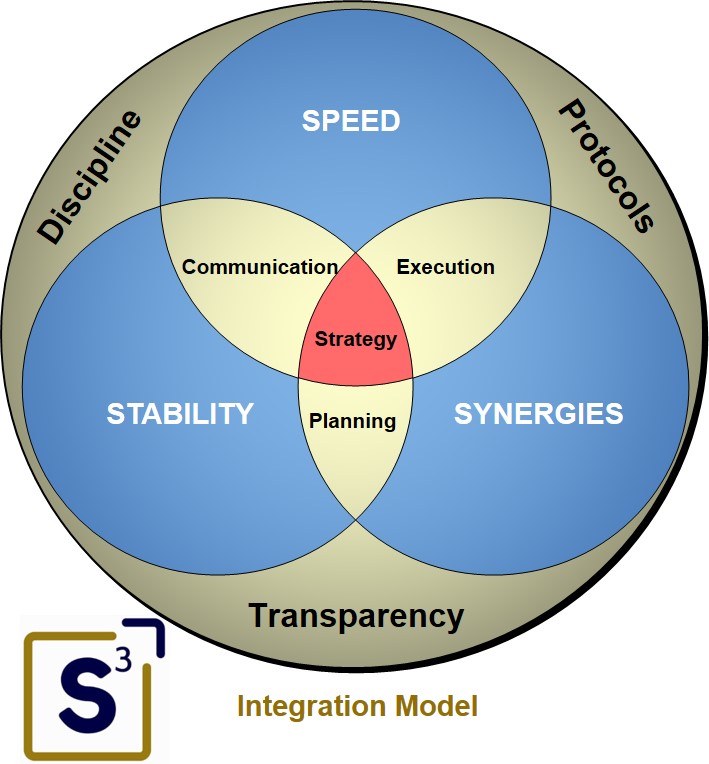

For years now, we have advocated the importance of focusing on speed, synergies and stabilizing the business and its core stakeholder groups as mission-critical elements of integration success. During the M&A Leadership Council’s Art of M&A Integration executive training, we present what we call the “S-3 Integration Model.” This model speaks to the extreme importance of leading with strategy, while delivering outstanding planning, execution and communications through a tightly coordinated and well managed process based on transparency, accountability and discipline.

But as every M&A pro knows, these objectives are extremely difficult to meet, given the enormous complexity, time and resource constraints inherent to any M&A effort. Even among extremely experienced acquirers we routinely hear comments like:

- “We have a due diligence process and a separate integration process. The two don’t connect well, and we tend to repeat key steps at the least opportune time.”

- “Risks were identified in diligence but they never got dealt with effectively during integration.”

- “There’s a lack of uniform M&A process maturity and capability between functions.”

- “Executives seem to be completely unaware of the resourcing requirements, time and workload of integration – and without real-time visibility of project status, milestones and synergies they consistently overestimate our ability to execute, and as a result, we miss deadlines…or worse.”

- “There’s a lack of accountability for the success of the overall integration. We over-emphasize the easy cost synergies but never seem to get to other, equally important opportunities.”

- “We don’t seem to learn from previous experiences and keep making the same mistakes over because this is ‘the way we have always done it.’”

- “It is impossible to track and manage all the cross-functional dependencies.”

- “Our process inefficiencies cause substantial delays and errors. If we could just eliminate the rework, redundancy, version control errors and time-intensive tracking and reporting steps, we would be way ahead of the game.”

Unfortunately, these are not isolated experiences. In fact, these difficulties are validated in a forthcoming study from M&A Partners, The State of M&A Integration Effectiveness 2014, based on an extensive survey of over 150 experienced acquirers. This study reveals that 71% of respondents indicated they would rate their overall integration process effectiveness level as “very poor, poor or average.”

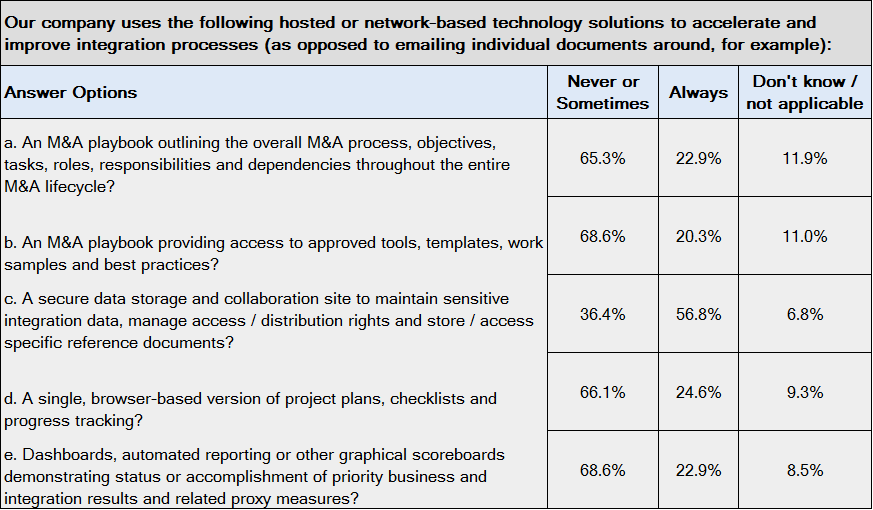

One question in this study analyzed the respondents’ use of specific software “point-solutions” or tools specifically intended to support M&A integration. This question identified five different aspects of integration process management that are now commonly supported by widely available third-party or homegrown software solutions. Categories included:

- An M&A playbook outlining the overall M&A process, objectives, tasks, roles, responsibilities and dependencies throughout the entire M&A lifecycle

- An M&A playbook providing access to approved tools, templates, work samples and best practices

- A secure data storage and collaboration site to maintain sensitive integration data, manage access/distribution rights and store/access specific reference documents

- A single, browser-based version of project plans, checklists and progress tracking

- Dashboards, automated reporting or other graphical scoreboards demonstrating status or accomplishment of priority business and integration results and related proxy measures

For purposes of this study we did not analyze the use of virtual data rooms (“VDRs”) strictly for due diligence purposes, but item c, above, captured the use of common VDR functionality applied to the integration process. Our hypothesis was that given the costs, complexity, risks and strategic importance of integration, and given the prevalence of many outstanding third-party software solutions on the market, a significant majority of acquirers would already be using these tools consistently as a core part of their process methodology and project management disciplines. What we see in this particular data set, however, is both a disappointment and an important opportunity for improvement. A frequency response summary of our findings on this important question appears in the exhibit below.

While we are encouraged that 57% indicate they “always use” a VDR or similar capability during integration (part c); the other findings (parts a, b, d, and e) are not so rosy, with only 20% to 25% of organizations indicating they effectively leverage other important software solutions on a consistent basis. Write-in comments do indicate that many organizations are currently in the midst of developing or deploying their versions of relevant M&A software tools, but the overwhelming conclusion should be clear. Namely, the time has come to upgrade M&A integration management processes with simple, secure and state-of-the-art software solutions as an important part of every acquirer’s basic “readiness capability.” This later criterion is seen as especially important as several write-in comments indicate their prior attempts or current installations of M&A software tools had resulted in overly complex, “unfathomable,” or otherwise highly user-unfriendly outcomes, and as a result, were only used by some functions, on some deals, and “if they had to.” Hardly a way to build process maturity and achieve more consistently outstanding integration results!

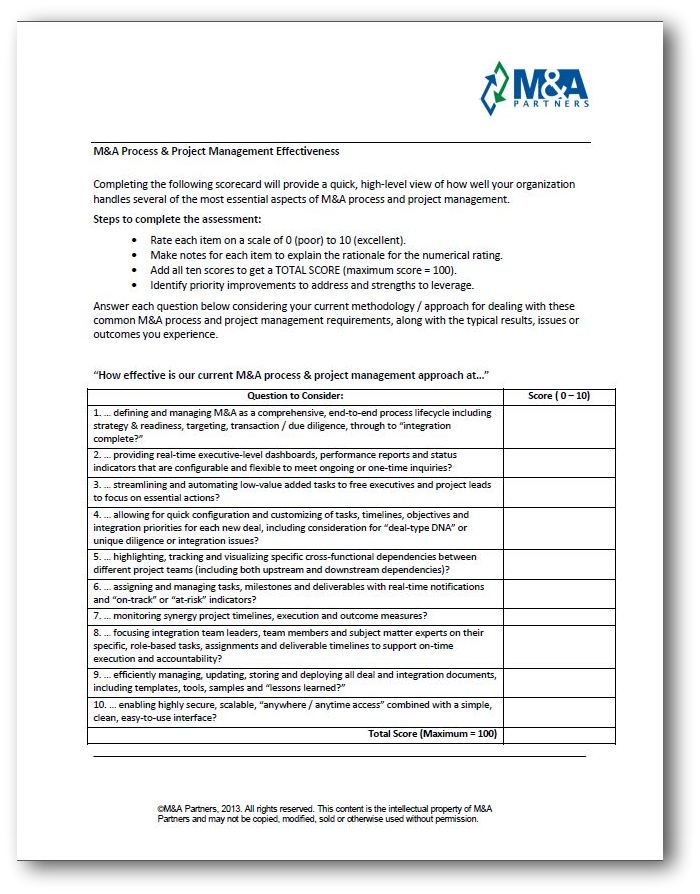

Rapid Assessment Tool

As with any capability gap, awareness is half the battle. A benchmark or sounding board is a helpful way of raising your M&A game to the next level as you take stock internally and dialogue with others in your organization about future needs, challenges and opportunities to get better at M&A. Toward that objective, we offer this Rapid Assessment Tool.

As with any capability gap, awareness is half the battle. A benchmark or sounding board is a helpful way of raising your M&A game to the next level as you take stock internally and dialogue with others in your organization about future needs, challenges and opportunities to get better at M&A. Toward that objective, we offer this Rapid Assessment Tool.

Regardless of your current methodology, and regardless of whether you currently use manual processes or a variety of homegrown or third-party solutions, consider using this quick assessment to highlight both strengths to build on and potential improvements needed for your continued success and integration effectiveness.

Click on the graphic above to access your copy of the Rapid Assessment Tool.

******************************

Introducing the M&A Cockpit™ Powered by Deven Software

As we have supported best-in-class acquirers over the years, we have had the opportunity to use and evaluate many outstanding software solutions – including our own platform and several third-party solutions. But in our experience, one platform stands out as clearly superior from multiple perspectives, including: having a great user interface; robust functionality; ease of configuration and cost. That platform is from Deven Software, and that’s why it is a distinct honor to announce an important new strategic partnership between M&A Partners and Deven Software. As more fully detailed in the press release linked here, we are joining forces to focus our respective areas of expertise on helping acquirers increase their ability to achieve more consistent, repeatable M&A execution success.

A comprehensive overview briefing deck is available here and online at mapartners.net. Finally, please join me in welcoming our new partners, the outstanding team at Deven Software…Nick Perdikis, CEO/CTO; Paul Saldo, CSO; Michelle Zurlo, Director of Marketing & Social Media; Charlie Crew, CFO; Doug Smith, Principal Advisor and M&A Executive; and of course, the entire development team! We look forward to working with you to advance our shared vision of improving the success rate and return on investment for the M&A community.

Photo: webopedia.com